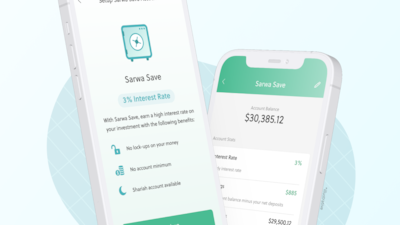

UAE low-cost robo-advisory platform Sarwa has unveiled a cash account with a 3 per cent annual interest rate, as banks in the Emirates continue to offer customers low savings yields despite eight consecutive base rate rises by the UAE Central Bank since last year.

Sarwa Save comes with a zero-transfer cost for local dirham accounts, requires no minimum balance and has no management fees, Sarwa said.

The account will hold customer funds in US dollars. It will be held offshore with Sarwa's banking partner Saxo Bank in Denmark.

Sarwa, which is regulated by the Abu Dhabi Global Market, obtained approval for the new product from the Financial Services Regulatory Authority, the free zone's regulator.

“While we are strong believers in long-term passive investing, we are also conscious of how market conditions might affect short to medium-term goals,” said Mark Chahwan, co-founder and chief executive of Sarwa.

“Having a short-term investing option is an important part of a good financial plan. Our clients were asking for a product to park their cash while earning returns.”

Earlier this month, the UAE Central Bank raised its base rate for the overnight deposit facility by a quarter of a percentage point to 4.65 per cent, from 4.4 per cent, after the US Federal Reserve increased its policy rate by 25 basis points as it continues to fight inflation.

Most central banks in the GCC follow the Fed's policy rate moves due to their currencies being pegged to the US dollar. Kuwait is an exception in the six-member economic bloc as its dinar is linked to a basket of currencies.

While the cost of borrowing has risen in line with the rate increases, banks have been slower to pass on the benefits to savers.

Most local banks in the UAE have minimum salary and minimum balance requirements for their savings accounts.

For example, ADIB's Ghana savings account offers an interest rate of 0.36 per cent but stipulates a minimum salary of Dh20,000 and minimum balance of Dh3,000.

An Emirates NBD savings account offers an annual return of 0.20 per cent while an HSBC savings account has an interest rate of 0.05 per cent.

“The average yield on saving accounts in the UAE banks is around 0.8 per cent as it stands today. Sarwa Save offers almost four times this amount,” Mr Chahwan said.

Sarwa Save is aimed at people who are about to start their investment journey or investors who want to earn a return on their parked cash, he said.

The product is available to new and existing customers through the Sarwa website and mobile app.

For those looking for a Sharia-compliant equivalent, Sarwa offers Save Halal, a low-risk money market funds portfolio that consists of cash and cash-equivalent securities projecting a return of 3 per cent.

This product charges a management fee of 0.5 per cent, which is accounted for in the projected return rate.

The cash account can be integrated with Sarwa Invest accounts and it does not charge a fee for transfers.

The product makes it easier to centralise different investments a customer looks for in one app, from hands-off long-term investing to self-directed trading, and an option of interest on cash, Sarwa said.

co-founder and chief executive of Sarwa

“Diversification is at the essence of a sound investment strategy, and we’re happy to continue expanding our range of wealth management products,” he said.

“Our aim is to help everyone reach their financial goals by managing their money through different tools, all in one place.”

Founded in 2017, Sarwa, which has 100,000 registered users, uses artificial intelligence to rate an investor’s risk tolerance and assigns them a tailored investment portfolio of exchange-traded funds, charging them lower advisory fees than traditional financial advisers and wealth managers.

In August 2021, Sarwa raised $15 million in a funding round led by Abu Dhabi's Mubadala Investment Company.

The series B round brings the trading platform’s total funding from regional and international investors to about $25 million since it was founded, the company said at the time.