Billions of dollars have been wiped off the value of brands since the start of this year.

Banks have fared the worst, but not all sectors have suffered. A financial league table, usually released every January, was updated recently to reflect the volatility in global markets.

It revealed that stock market panic resulted in a 25 per cent - US$6.3 trillion (Dh23.13tn) - reduction in intangible asset values. The fall may be huge but it reflects just a 2.4 per cent drop in the combined value of brands.

So which were the biggest losers?

Banks in the top 100 have lost $25.9 billion, or 7 per cent, of their total brand value since January, according to the Global Intangible Financial Tracker League Table (Gift), which is run by Brand Finance.

"As stock markets around the world falter, we are seeing a drop in the amount of intangible value global businesses hold and the value of the individual brands," says David Haigh, the chief executive of Brand Finance.

"Even the world's biggest businesses are not immune to change."

Bank of America experienced a fall of $5.3bn, slipping eight places to 14 since the start of the year, while Wells Fargo and Santander also saw heavy losses. Insurance brands were also hit hard, with Axa faring the worst, losing $1.6bn of its brand value.

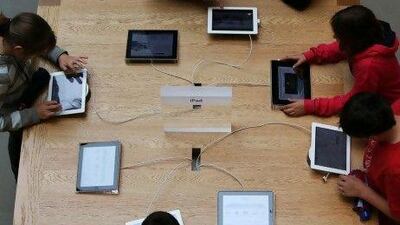

But it is not all bad news. Brands in the technology and electronic sectors made big gains, including Apple, which increased its brand value by one third, making it more valuable than Microsoft for the first time. Google, Apple, Microsoft and IBM all appear in the top five.

The losses in the banking sector are understandable, but the gains made by the tech and electronics sectors should come as no surprise.

"The performance of the companies is related to consumer demand. That's why we will continue to see some issues in the banking industry," says Zed Ayesh, an expert in business development.

"Tech companies increased because they are introducing new technologies and new inventions and they are in demand. The more demand and more awareness the stronger the brand you will have," says Mr Ayesh, the managing director of Flagship Consultancy.

A brand is a critical part of a company's balance sheet, but it is not always seen that way, says Tarek Sultani, the managing director of Siegel+Gale Middle East, a branding consultancy.

"I think a lot of companies in the Middle East underestimate its importance in driving and sustaining long-term value, ie shareholder return and corporate capitalisation," he says.

The fluctuation of brand value depends largely on the nature of the industry in which the company operates. Most of the growth in finance and banking comes from sales, price competition and expansion, so brand value relies on customer experience, service and trust.

"In reality, very few of them do it well. Financial institutions are struggling to offer their customers simple engaging brand experiences, because they are hindered by the need to push sales, and their internal processes," says Mr Sultani.

The pace of the technology industry is much faster, pushing companies to invent ever more products.

"The technology companies will have huge spikes in the brand value, but at the same time, I believe there is constant risk of very severe and sudden drops, if for example a new product flops, or a competitor comes up with a new technology that hits the market faster," says Mr Sultani.

"So while banks, insurance companies, and financial institutions are here to stay, technology companies will rise and fall quickly."