Deliveroo's disastrous debut on the London Stock Exchange was caused by scrutiny of the treatment of its delivery riders and doubts among the UK's top fund managers over the company's sustainability.

The British food delivery start-up listed on the LSE at 8am on Wednesday after months of speculation, but its arrival on the main listing was met with a "cool reaction" from the City.

Analysts called the listing disastrous after the share price plunged 31 per cent to £2.71 in early trading, wiping more than £2 billion ($2.75bn) off Deliveroo’s £7.59bn valuation. It ended the day at £287.45 with a market capitalisation of £5.23bn, a drop of 26 per cent.

“It wasn’t the start the takeaway food delivery firm had wanted,” said Lee Wild, head of equity strategy at interactive investors.

“IPOs typically rise in value when they begin trading publicly, which has attracted criticism from retail investors and investment platforms. But preparations for this float have not been ideal, and there were several clear warning signs that all was not well.”

Set up in 2013 by American Will Shu, 41, the company grew quickly earning the crown as the UK's fastest-growing technology firm by Deloitte in 2017, with an incredible growth rate of 107,117 per cent over its first four years.

Mr Shu's personal mission to improve the takeaway food Britons ate saw him create a unique algorithm to find the most efficient way of distributing orders based on the location of restaurants, riders and customers.

He become the company's first rider; now the company works with 50,000 across the UK and even more in its locations in across Europe, Asia, Australia and the Middle East.

The run-up to the listing, the largest IPO in Britain for a decade, was marred by criticism. This week, Deliveroo trimmed its share price towards the bottom end of the range citing "volatile" market conditions.

Meanwhile, a number of the UK’s top fund managers, including Aviva and Aberdeen Standard, said they would not participate, on account of ESG (environmental, social and corporate governance) concerns over treatment of the company’s riders.

Employees are not offered contracted hours, sick pay or paid holidays, placing Deliveroo firmly in the gig economy.

This became something of a sticking point for big-name investors in the run-up to the IPO, who feared worker exploitation could lead to legal action or strikes further down the line over rights or pay.

“Taxi firm Uber has already been forced to change its ways, especially around contracts and pay,” Mr Wild said.

Investors sounded the alarm over Deliveroo’s dual-class structure, which allows co-founder and chief executive Will Shu to retain control of the business for three years.

“They’re also turned off by Mr Shu, who still has more than 50 per cent of shareholder voting rights,” Mr Wild said.

Before the listing went live, the company's existing shareholders sold £500 million of Deliveroo stock at £3.90 a share, with new shareholders subscribing for at least £1bn of shares. This valued the company at £7.59bn.

However, while existing shareholders, such as Amazon and Mr Shu himself, walked away with a sizeable pay out, new shareholders saw the value of the stock plunge.

“That looks like great business for the sellers as Deliveroo shares began falling as soon as the market opened,” Mr Wild said.

Deliveroo’s stock hit a low of £2.71 shortly after the listing, 31 per cent below the offer price, before recovering slightly to around the £3.00 level and closing at £287.45, a drop of 26 per cent on the opening price.

Joshua Mahoney, senior market analyst at global online trader IG, said Deliveroo’s IPO was a “flop” that had “already disappointed its new shareholders".

As a result, the takeaway delivery platform has done far more to highlight the risks of investing in fresh listings, he said, than deliver value to their 70,000 new shareholders.

“Sharp moves on IPO day are typically attributed to a bank either overvaluing or undervaluing a stock, and this is no exception,” Mr Mahoney said.

"This listing comes at exactly the wrong time for shareholders, with rising treasury yields bringing pressure on growth/tech stocks, and valuations based on a period of massive upheaval for the restaurant business.”

The other concerning factor raised by investors and analysts is the fact the company does not make a profit, even though the pandemic provided the biggest boost it could hope for.

Deliveroo's food orders in January and February were up 121 per cent on 2020, driven by soaring demand in the UK and Ireland during coronavirus lockdowns.

Despite surging sales, the group suffered a net loss totalling £226m last year, after being hit by higher costs caused in part by taking on more riders to meet the demand.

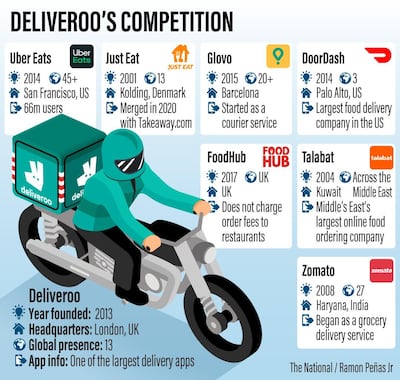

Deliveroo went public to enable it to grow and beat off competition from the likes of Anglo-Dutch group Just Eat Takeaway and US giant Uber Eats.

Fawad Razaqzada, market analyst at ThinkMarkets, said as well as valuation concerns, its future path of profitability is also under question because of the way it treats it workers.

In the UK, riders are paid according to a complex formula based on factors such as the time of day and the distance to a delivery.

However, some riders complained that the system is opaque while others said that their earnings have fallen over time.

One rider working for the company in north London complained that his earnings of more than £1,000 a week fell to about £300 for a 40-hour week – the equivalent of £8 an hour once he deducts for bike insurance, oil, petrol and parking fines.

A Deliveroo representative said that riders can earn £13 per hour on average during busy times and that overall satisfaction is at an “all-time high”.

“Deliveroo’s gig economy model means drivers won’t get paid holidays, pensions and other benefits,” said Mr Razaqzada.

“But if the government were to force Deliveroo to treat its workers as employees, then serious questions will be raised about the company’s path to profitability given that its margins are already thin as they are and the competitive nature of the delivery industry.”

The criticism may be hard for Mr Shu to take, particularly as he continues to ride occasional shifts himself delivering takeaways.

However, Mr Shu said in the past that the company’s riders like the flexibility the job offers, as well as the easy entry because all they need is a bicycle.

Ultimately, listing a company with a market capitalisation of £7.59bn is quite an achievement for the former banker, who set up the company in 2013 after resorting to late-night supermarket trips for his dinner during his time at Morgan Stanley’s London office.

At the time, he could not understand why “great food wasn’t available for delivery” and wanted to do something to ensure Londoners could get quality meals similar to those he ordered while working as a banker in New York.

While Deliveroo has changed not only the takeaway industry but also how people work, Mr Shu has some work to do to convince investors his model is sustainable.

Mr Mahoney said the company has the ability to grow into its valuation over time, but the expectation that we will see poor momentum for pumped-up growth stocks “doesn’t exactly fill investors with complete confidence”.

“Deliveroo firmly falls into the pandemic winners’ category, but at a time when traders are looking for value recovery plays, this doesn’t look like the most attractive proposition,” he said.

Meanwhile, Mr Wild noted that Deliveroo can cancel the IPO at any time until April 7.

“That’s because the shares are currently trading conditionally – what’s called a ‘when issued’ basis. It is highly unlikely this will happen, but it’s worth pointing out,” he said.