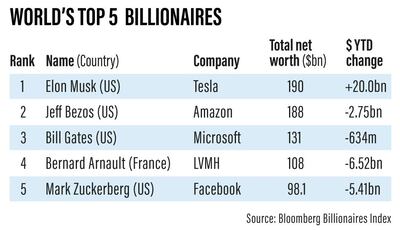

Elon Musk, the billionaire founder of Tesla Motors who overtook Jeff Bezos as the world's richest person last month, could see his fortune swell to almost $270 billion if the electric vehicle maker hits a target price of $1,200 per share forecast by a technology analyst, who predicted a surge in the company's shares last year.

Mr Musk, who owns about 20 per cent of the company's 947.9 million shares, is currently worth $194.8bn, according to the Bloomberg Billionaires Index. He also sits on around $42bn of unrealised paper gains on vested stock options, received in 2012 and 2018.

“2020 was a breakout year for Tesla, but in our view, the fireworks aren't over. Even after a 10 times' return over the past 12 months, we don't think investors should be selling this stock,” Alex Potter, a senior research analyst at US investment bank Piper Sadler said in a note to clients.

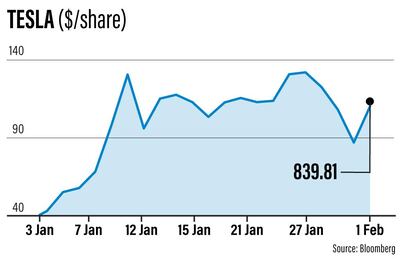

Tesla's stock closed 5.8 per cent higher at $839.80 per share on Monday. The company's shares have climbed almost 440 per cent in the past 12 months and more than 15 per cent since the start of this year.

Mr Potter, who specialises in transportation technology with a keen focus on EVs and automotive e-commerce, raised his target price on Tesla to $1,200 based on model mapping out the cash flows it expects the company to generate over the next 20 years. The new target is a substantial increase on a previous target of $515 set in September, when the company was trading at about $430 per share.

At $1,200 a share, he is valuing Tesla at about $1.1 trillion. The company's current market capitalisation stands at $796bn.

On Monday, Morgan Stanley analyst Adam Jonas also raised his price target on Tesla to $880 from $810 a share. He pegged this growth on increasing revenue from the company's automotive business and likely gains in its energy arm, which produces storage batteries.

Tesla, which generated about $2.8bn in free cash flow last year, is forecast to have nearly $37bn in free cash flow by 2025.

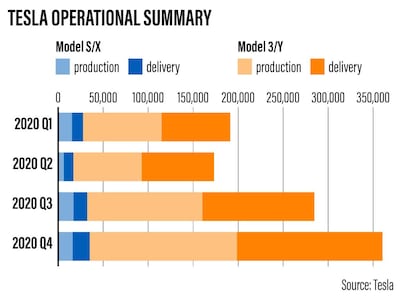

In an earnings call last week, the California-based company said it aims to deliver more than 750,000 cars this year. However, bullish Piper Sandler analysts expect 894,000 vehicle deliveries in 2021, which they project will increase to more than 9 million units in 2030.

“This level of production would rank Tesla among the top three auto makers globally. More important still, we anticipate a steady ramp in full self-driving software adoption starting in 2030 … this should have a big impact on margins,” Mr Potter said.

Tesla, which joined the S&P 500 index in December, delivered 57,039 Model X and Model S units, about 11 per cent of its total handovers, last year. It sold 442,511 units of the Model 3 and Model Y last year.

“Model S and Model X established Tesla’s brand, but financially, they are growing less relevant,” Mr Potter said.

“By the mid-2030s, the average Tesla should be approaching $30,000. Some models may be priced much lower than this. This reflects a mix shift toward new [cheaper] products, as well as price cuts on existing models.”

Lower average selling prices support the company’s long-term goals.

Tesla’s ASP of vehicles declined nearly 11 per cent in the last quarter, as the company’s product mix continued to shift to the more affordable Model 3 and Model Y.

Among EV manufacturers, Tesla continued to dominate 2019 as market leader. It accounted for 16 per cent of the market, compared with a 12 per cent share in 2018, according to McKinsey’s EV index.

The growing popularity of electric vehicles fuelled a 157 per cent year-on-year increase in fourth quarter profit for Tesla. Net profit rose to $270 million in the three months to December 31.