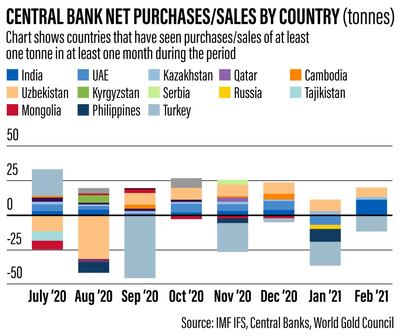

Central banks increased their gold purchases in February as they added 8.8 tonnes gold to their reserves during the month, according to the World Gold Council.

Gold sales by the central banks outweighed purchases in January. Banking regulators around the world sold a net 25.5 tonnes of gold in January as combined sales from Turkey and Russia outweighed buying elsewhere, the trade body said on Wednesday.

Meanwhile, central banks made net gold purchases of 20.6 tonnes in December 2020.

"Central banks tipped back into net purchases during February," Krishan Gopaul, market intelligence manager at the World Gold Council, said in a blog post.

“Buying from India [11.2 tonnes], Uzbekistan [7.2 tonnes], Kazakhstan [1.6 tonnes] and Colombia [0.5 tonnes] outweighed the only notable sale of gold by Turkey [-11.7 tonnes]. Year-to-date, this puts total global central bank net sales at 16.7 tonnes, the weakest start in over a decade.”

Gold plays an important part in central banks’ reserves, with the yellow metal comprising a significant portion of their holdings.

The pandemic has also boosted bullion prices as market uncertainty caused investors to rush to this traditional safe haven asset.

The price of gold rose to a record high of $2,084 an ounce last August, but it has since fallen more than 16 per cent to $1,732.

Gold prices have dropped as an accelerated vaccine rollout and positive economic data from the US sparked hopes about a faster economic rebound, weighing on the metal’s safe-haven appeal.

Gold purchases by central banks slowed sharply by 59 per cent in 2020 to 273 tonnes, the World Gold Council said in its Gold Demand Trends report in January this year. Official gold reserves grew by 44.8 tonnes during the final quarter last year, more than reversing the 6.5 tonnes of net sales in the third quarter.

Turkey was the largest annual gold buyer, adding 134.5 tonnes to its official gold reserves in 2020, while the UAE added 23.9 tonnes to its gold reserves, according to the report.

The US central bank holds the largest amount of gold reserves at 8,133.5 tonnes, accounting for 78.6 per cent of its total monetary holdings. This is followed by Germany’s Bundesbank with 3,362.4 tonnes and Italy’s Banca d’Italia at 2,451.8 tones, the council said.

The Central Bank of the UAE holds 50.7 tonnes of gold reserves and it accounts for 2.9 per cent of its total monetary holdings. The central bank sold Dh1.7 billion ($462.9m) of gold in January for the first time in three years "to capitalise on near-record prices" and to soften the impact of current global economic challenges, state news agency WAM said last month.

“Our expectation remains that central banks will be net purchasers in 2021, but the immediate outlook for central bank demand remains finely balanced,” Mr Gopaul said.

Demand for gold from the central banks remain uncertain, “with the sector bobbing between net sales and net purchases in recent months”, the council said.

The senior executive at the WGC said the recent net sales should not be looked upon as a change in sentiment towards gold as a reserve asset.

Selling has predominantly come from a small group of central banks whose “chunky sales have tipped the balance in certain months”, Mr Goupal said. These sales have been driven by several factors such as the pandemic-induced economic hardship, heightened local gold demand and coin-minting programmes, he added.

“We continue to see consistent moderate net buying from other countries, although these have been similarly concentrated among a small number of constituent banks,” he said.

The Reserve Bank of India, for instance, continued purchasing gold in March and added 6.5 tonnes to its gold reserves by March 26, the council said.

The Covid‑19 pandemic has not changed the view of central banks on gold, according to a joint survey of 26 banking regulators carried out by trade title Central Banking and Invesco in August 2020.

When determining a central bank’s gold holding, the benefits of diversification stand out as the most relevant factor for reserve managers, the survey found.