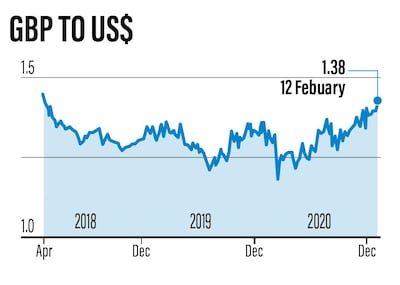

The British pound rose to its highest level against the US dollar since April 2018 on Monday as vaccine optimism signalled a strong economic rebound for the country.

Sterling rallied against the dollar in early trading, rising 0.36 per cent to hit $1.3899 at 10am London time, after the number of people to receive their first dose of a vaccine crossed the 15 million mark.

"The pound continues to remain on the front-foot with investors happy to buy every dip as it closes in on the $1.40 handle. It will not only get there, but go much higher over time after the Bank of England ruled out negative rates and as the UK avoided a no-deal Brexit at the back end of last year," Fawad Razaqzada, market analyst at Think Markets told The National.

Britain's economy shrank by a record 9.9 per cent in 2020 on the fallout from the coronavirus – the largest annual fall on record - but the country's rapid vaccine programme has boosted the outlook for this year.

While the Bank of England expects the economy to shrink by 4 per cent in the first three months of this year due to the new lockdown and Brexit-related disruption, analysts expect the outlook to brighten in the second half of the year, once the roll-out of coronavirus vaccines has provided protection to a sufficient proportion of the population.

"[The British pound] continues to reap the dividends of a successful vaccine roll-out and momentum is building towards a re-opening of the economy – probably starting with schools on March 8," said Chris Turner, global head of markets at ING.

Meanwhile, the FTSE edged higher on Monday morning as mining and energy stocks tracked strong gains in commodity prices and investors were hopeful that global vaccine distribution would quicken the economic recovery this year.

The commodity-heavy FTSE 100 was up 1.43 per cent to 6683.96 by 9.53am London time, boosted by miners Anglo American, Rio Tinto and BHP Group, and oil companies BP and Royal Dutch Shell.

The mid-cap FTSE 250 index added 1.23 per cent, gaining for a third straight session.

“While the strength of the pound has held back the index, the fact that UK and global monetary conditions are going to remain loose and government spending high, the long-term outlook on the FTSE is positive,” said Mr Razaqzada.

“This is especially because the UK is miles ahead of the EU in the vaccine race and after it avoided a no-deal Brexit.”