A ‘no-deal’ Brexit with the European Union could see the British pound plunge 10 per cent against the dollar, analysts say, as the UK inches towards the year-end deadline.

Stephen Innes, chief global market strategist at Axi, said on Thursday the pound would decline 10 per cent in a no-deal scenario but rise 3 per cent if a deal is agreed. However, he warned there was “a very narrow range of possibilities at this point”, with “potential concessions on fisheries and state-aid vs. no-deal risk”.

“Despite the more constructive risk backdrop overall, it is hard to see a substantial upside in GBP given those potential outcomes,” said Mr Innes.

“I expect any move higher to be met by selling from faster money. The risk is skewed, especially given positioning where my sense is the street is still long GBP – despite some reduction in early September as negotiations broke down.”

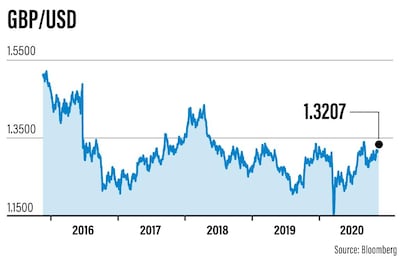

The pound first plunged in value in 2016 when the UK voted to leave the EU in a national referendum. In March, sterling fell to its lowest level against the US dollar since 1985, when it dropped to $1.15 amid fears the coronavirus pandemic would send investors flocking to safe haven currencies.

The pound was trading at $1.32 against the dollar at 10.45am UK time on Thursday, after a rally on Wednesday saw sterling trade at a one-week high of $1.3307.

Global bank HSBC was equally bearish on sterling earlier this week, when its chief analyst said it expects to see the pound at $1.25 to the dollar by the end of 2021 and doubts that recent resilience in the currency can last.

"We maintain a counter-consensus view on GBP, and expect the currency to weaken from current levels," said Dominic Bunning, head of European FX research at HSBC Bank.

"Even with a Free Trade Agreement, increased costs in the form of “non-tariff barriers” will be sizable – by up to 14 per cent based on UK Treasury analysis. A no-deal outcome would see even bigger barriers to doing business," he said.

Other analysts are more bullish on the pound’s fortunes if a trade deal is agreed in the coming days, with Fawad Razaqzada, market analyst at ThinkMarkets, saying the better the agreement for the UK, the more significant a potential sterling rally will be.

“The pound could head to high $1.30s, possibly low $1.40s, on the back of any deal, as this would remove concerns about a no-deal outcome, a possibility that still exists and thus partially baked in the price,” said Mr Razaqzada.

"A favourable deal could see the cable rise to $1.45 in the space of a few weeks, while a no-deal scenario could lead to a massive drop in the exchange rate as this would be a shock given the recent optimism that a deal will be struck.”

Britain formally quit the European Union in January but has continued to observe all its rules during a transition period that ends on December 31.

Reports suggest that London and Brussels are now inching towards a trade agreement ahead of the year-end deadline, with the UK also nearing a trade deal with Canada.

Traders are "thrilled" about the prospect of a Canada deal, said Naeem Aslam, chief market analyst at London's Avatrade, because the UK is Canada's third biggest trade partner after the US and China. Canada’s exports to the UK amounted to nearly C$14 billion ($10.7bn) this year, and it has imported goods worth nearly C$6.9bn.

"In terms of Sterling, the currency has bullish momentum, and news like the above is going to make traders more comfortable," he said.

"Any announcement in relation to the individual trade agreement with other countries is likely to reduce the uncertainty with respect to Brexit, and this could easily push the Sterling all the way to $1.35 against the dollar."

KPMG said on Wednesday that failure to strike a post-Brexit trade deal with the EU would more than halve the pace of Britain's economic recovery from the coronavirus pandemic.

Gross domestic product growth will reach 4.4 per cent in 2021 without a deal, the accountancy group estimated. That compares with a 10.1-per-cent expansion if current trade links were maintained, KPMG said.

Joshua Mahony, senior market analyst at online trader IG, said speculation that David Frost has told Boris Johnson to prepare for a potential trade deal by next Tuesday has helped lift the pound despite ongoing uncertainty.

"The rise in the pound over recent months does highlight expectations of a breakthrough before the year-end deadline. It seems we have got to a point where traders have become accustomed to a no-deal scenario, with even a thin deal likely to bring substantial upside for the pound," he said.