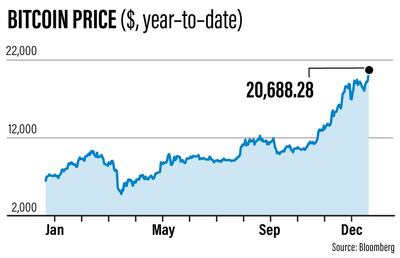

Bitcoin, the world's most popular cryptocurrency by traded volume, broke through the $20,000 barrier for the first time on Wednesday amid rising investor interest in it.

The cryptocurrency was trading at $20,673.31 at 6.55pm UAE time. It has almost trebled in value since the start of the year, when it was trading at $7,158.

"Today is a good day for Bitcoin believers because the price has reached a major milestone and it has proved to the world that if you do not believe in Bitcoin, then think again. This beast is unstoppable," said Naeem Aslam, chief market analyst at brokerage Avatrade.

Bitcoin has jumped in value over the past few months as payment networks such as PayPal and Square have begun using the cryptocurrency and more asset managers have taken an interest.

In the US, Fidelity Investments began offering a Bitcoin index fund to wealthy investors in August and recently published a blog in which it attempted to repudiate some of the most common criticisms of the asset.

"Bitcoin is a unique digital asset for an increasingly digital world that requires digging deeper than the surface level to understand its core properties and trade-offs," the company said. "It pushes onlookers to question pre-conceived notions of what is right and widely accepted to begin to understand its full value proposition."

Investing in cryptocurrencies remains risky, though, with the price of Bitcoin proving to be extremely volatile.

Monthly volatility for Bitcoin stood at 70 per cent on Wednesday, according to an index compiled by cryptocurrency exchange Bitmex.

Bitcoin rallied to touch $20,000 in December 2017 but later crashed, falling to as low as $3,000 a year later.

"Bitcoin bulls continue to derive strength from increased demand from large investors and rising expectations that it may become a mainstream payment method. A broadly weaker dollar has complemented the upside," said Lukman Otunuga, a market analyst at brokerage FXTM.

"As more investors potentially join the party amid Bitcoin’s limited supply, this could spell more upside for the cryptocurrency."