Apple’s net profit more than doubled in the company's fiscal 2021 second quarter that ended on March 27, as earnings across all categories of products reported double-digit growth.

The Cupertino company’s net profit surged 110 per cent yearly to more than $23.6 billion.

Revenue surged 54 per cent on an annual basis to $89.6bn in the quarter. This was the record for March quarter sales in the history for the iPhone maker.

The earnings were driven by the robust sale of 5G-enabled iPhone 12 series phones, launched in October, and increased sales of iPads and Macs as people continued to work and learn from home to stem the spread of coronavirus.

“This quarter reflects both the enduring ways our products have helped our users meet this moment in their own lives, as well as the optimism consumers seem to feel about better days ahead for all of us,” said Tim Cook, the company’s chief executive.

“Apple is in a period of sweeping innovation across our product line-up, and we are keeping focus on how we can help our teams and the communities where we work emerge from this pandemic into a better world."

The results topped analysts' estimates and increased the stock price of the company by 2.4 per cent to $136.7 a share in after-hours trading.

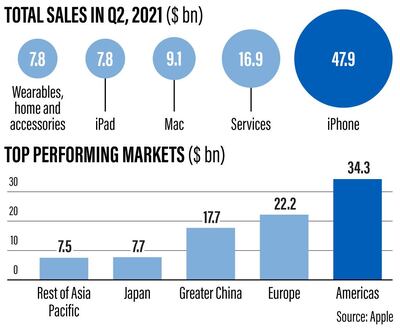

The sales of iPhones constitute more than 53.5 per cent of the revenues. It surged more than 65 per cent to $47.9bn in the quarter from the year earlier period.

The company’s total revenue from services grew nearly 26.9 per cent annually to $16.9bn, while revenue from wearables, home and accessories products increased almost 24.6 per cent yearly to more than $7.8bn.

Revenue from iPads and computers surged 73.9 per cent to $16.9bn.

“March quarter performance … included revenue records in each of our geographic segments and strong double-digit growth in each of our product categories … driving our installed base of active devices to an all-time high,” said Luca Maestri, Apple’s chief financial officer.

Apple generated an operating cash flow of $24bn and returned nearly $23bn to shareholders during the quarter, Mr Maestri said.

“We are confident in our future and continue to make significant investments to support our long-term plans and enrich our customers’ lives,” he said.

Apple’s sales outside the US market accounted for nearly 67 per cent of the company's total second-quarter revenue.

Despite the US-China trade issues, Apple managed to gain significant new ground in the Greater China market of mainland China, Hong Kong and Taiwan, which added $17.7bn to its revenues in an annual increase of almost 87.4 per cent.

Apple produced nearly 199 million handsets last year, grabbing a market share of 16 per cent, according to Taipei market intelligence company TrendForce.

It plans to produce up to 96 million iPhones in the first half of 2021, a 30 per cent year-on-year increase, after demand for its first 5G handsets surged amid the Covid-19 pandemic.

Apple did not issue official guidance about the future revenues and profits. Citing uncertainty in business, it stopped offering guidance since the start of the Covid-19 pandemic.

Mr Maestri told analysts that the company expected June quarter revenue to increase by double digits on a yearly basis, but the company is facing some supply shortages due to the global chip shortage.

Last year, it delayed the launch of iPhone 12 series by at least a month due to the supply chain disruptions.

Apple increased the cash dividend by 7 per cent to $0.22 a share and authorised an increase of $90bn in share buybacks.

It is significantly up from the last year’s spending of $50bn.