Shares of Lucid Motors, the luxury electric vehicle manufacturer backed by Saudi Arabia's Public Investment Fund (PIF), have surged more than 90 per cent since the start of this year amid speculation that the sovereign wealth fund plans to buy out the company.

Shares of the California-based company have jumped more than a third since January 23 through to the close of trading on Monday, according to market data.

That made Lucid the third-highest gainer and the sixth most traded stock on the Nasdaq on Friday, after speculation that appeared to have started on the daily deals website Betaville.

In pre-market trading alone on Monday, Lucid's volume surpassed 17 million; the company's average session trading volume is about 30 million. The stock eventually pared gains, down 1.87 per cent in after-hours trading.

However, the company's stock price is down more than 60 per cent from a year ago. For all of 2022, it plunged 84 per cent, worse than Tesla's 70 per cent plunge amid chief executive Elon Musk's contentious takeover of Twitter.

Lucid has not commented on the speculation. The PIF, Saudi Arabia's sovereign wealth fund that owns 65 per cent of Lucid, did not respond to a request for comment from The National.

The global EV market continues to grow amid a government and societal shift towards energy conservation, with both the consumer and commercial verticals tapping into the technology's potential.

Innovation and sustainability are among the key pillars of Saudi Arabia's Vision 2030 programme, a major economic diversification drive to reduce its reliance on oil and tap into other high-growth industries.

The continuing focus on more environmentally friendly vehicles presents an opportunity for EV brands and their investors. Saudi Arabia, the Arab world's biggest economy, aims to boost its EV production and tap into this potential.

The global EV market is expected to expand to more than 39.2 million units by 2030, from about 8.15 million in 2022, a near 22 per cent compound annual growth rate (CAGR), according to data from research firm Markets and Markets.

The sector's value is forecast to hit more than $1.1 trillion by 2030, from an estimate of $208.6 billion in 2022, at a CAGR of more than 23 per cent, a study from Precedence Research showed.

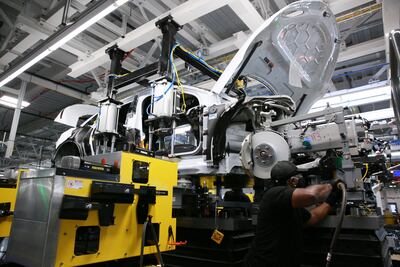

Having Lucid in its green arsenal will boost Saudi Arabia's goals of becoming a leader in the EV industry. The kingdom announced Ceer, its first EV maker, in October, a partnership with Foxconn, the Taiwanese semiconductor maker and major parts supplier to Apple.

Later that month, Ceer bought land worth $96 million in King Abdullah Economic City, where it plans to build its factory.

The PIF bought into Lucid in 2018, investing $1 billion in the company that is competing with Tesla.

In February 2021, the PIF, US investment firm BlackRock and others poured an additional $2.5 billion into Lucid.

Last year, Lucid chairman Andrew Liveris said the company planned to build a factory in Saudi Arabia by 2025 or 2026.

“Now that we are successfully producing and selling cars in the US, our attention is turning to this factory here,” he said at that time. The factory aims to produce 155,000 cars per year.

In August, Lucid announced plans to raise $8 billion through new offerings as the company aims to boost production.

Lucid's market capitalisation on Monday was at $21.63 billion, compared with Tesla's $522.22 billion value.

Lucid makes the $169,000 Air Dream Edition limited production saloon car. However, it has been struggling to deliver the vehicles having shipped out only 4,369 in 2022.

Its three other models are the Air Pure, Air Touring and Air Grand Touring.

The cut-throat competition in the EV market is also making things more challenging. Tesla's price cuts, which the car maker made to boost sales, are also preventing Lucid and other smaller players from cornering market share.