Tesla, the world's most valuable car maker, posted a strong second quarter net profit despite supply chain disruptions and it maintained its production forecasts.

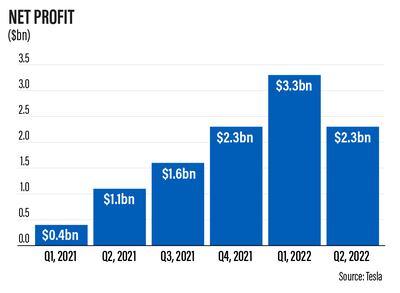

The company defied the pandemic-induced supply chain disruptions and global semiconductor shortage that affected the global motor industry to earn about $2.3 billion in net profit in the three-month period to the end of June beating analyst's estimates of $1.9bn. The company's net income in the second quarter of last year was $1.1bn.

While the quarterly results were strong net profit was nearly 32 per cent less than the first three months of this year as Tesla had lower car deliveries in the April to June period, compared to the March quarter.

This is the 12th straight profitable quarter and the fifth consecutive three-month period with more than $1bn profit for the world’s biggest electric vehicle maker.

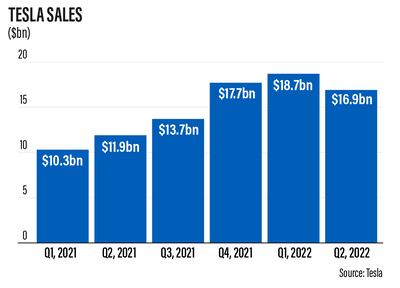

Revenue during the quarter jumped 42 per cent to more than $16.9bn, missing analysts’ expectations of $17.1bn. This was the seventh time in a row the company reported $10bn or more in sales. It was nearly 10 per cent less on a quarterly basis.

“We continued to make significant progress across the business during the second quarter,” Tesla said.

“Though we faced certain challenges, including limited production and shutdowns in Shanghai for the majority of the quarter, we achieved an operating margin among the highest in the industry of 14.6 per cent, positive free cashflow of $621 million and ended the quarter with the highest vehicle production month in our history."

The Nasdaq-listed company's stock price gained about 1 per cent to $742.50 at the close of trading on Wednesday, giving it a market capitalisation of more than $769.52bn. Its shares increased about 1.5 per cent in after-hours trading.

Tesla's stock price is down about 38 per cent since the start of the year and has dropped about 40 per cent from its all-time high $1,243.49 last year.

Tesla said its cash, cash equivalents and short-term marketable securities surged “sequentially by $902m to $18.9bn” at the end of the last quarter.

It was driven mainly by free cashflow of $621m, partly offset by net debt repayments of $402m.

The Texas-based company said that by the end of last month, it had converted nearly 75 per cent of its Bitcoin purchases into fiat currency.

The conversions in the last quarter added $936m of cash to Tesla’s balance sheet.

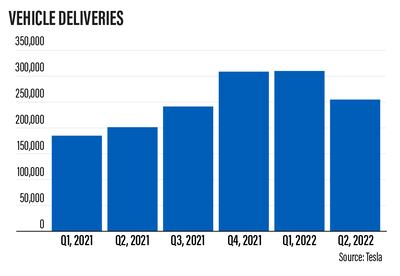

Tesla delivered 254,695 vehicles in the second quarter, about 26.5 per cent more than the cars sold in the second quarter of last year.

But it ended a two-year streak of quarterly gains after a coronavirus-related shutdown at Tesla’s factory in Shanghai affected production.

It dropped almost 17.8 per cent on a quarterly basis and missed a forecast of 261,181 vehicle deliveries based on an average of analyst estimates compiled by Bloomberg.

In the second quarter, it sold 238,533 units of Model 3s and Model Ys, although it delivered only 16,162 units of its more expensive Model S saloons and Model X SUVs, which are priced more than $75,000.

In the second quarter, “we saw a continuation of manufacturing challenges related to shutdowns, global supply chain disruptions, labour shortages and logistics and other complications, which limited our ability to consistently run our factories at full capacity”, Tesla said.

The company said it planned to increase its manufacturing capacity “as quickly as possible” and over a multi-year horizon, it expects to achieve 50 per cent average annual growth in vehicle deliveries.

“The rate of growth will depend on our equipment capacity, factory uptime, operational efficiency and the capacity and stability of the supply chain,” it said.

“We have sufficient liquidity to fund our product roadmap, long-term capacity expansion plans and other expenses."

Tesla produces its vehicles in Fremont, California; Austin, Texas; Shanghai, China; and Berlin, Germany.

In the previous quarter in its energy segment, Tesla’s solar deployments increased by 25 per cent on an annual basis to 106 megawatt, the strongest quarterly result in over four years.

Meanwhile, the energy storage deployments decreased by 11 per cent year-on-year in the June quarter to 1.1 GW/h.

It was mainly due to semiconductor challenges, which are having a greater effect on Tesla’s energy business than its automotive business.

“Demand for our storage products remains in excess of our ability to supply,” the company said.