For various reasons over the past few years I have been living in a cash world – I either have the money for a payment – or I don't. This is both good and bad: I haven't overextended myself, but it also means that I have not leveraged, taken advantage of any potential equity I have built up or the like. I'm not anti-debt – certain types of debt can be enabling, not disabling. More on that another time. I am currently thinking through the next few decades of life, and exploring options.

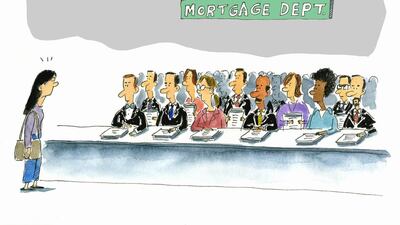

One of which is whether to take on a mortgage. It's been many many years since I engaged with banks in any way other than to deposit or withdraw money. And having started the process, the phrase that comes to mind is: "Can't see the wood for the trees".

I filled in various forms. Many email attachments and sightings of original documents later, I had an actual meeting with a representative. All documents, supporting documents, and any and everything related were presented, verified, copied, you name it.

I then got emails requesting yet more documents – I had explained that I'd be travelling and would not be able to oblige until I was back.

I then stopped answering phone calls from the bank, or bothering to reply to the "reminder" emails that it started sending out – obviously oblivious to what I had actually written in my reply.

The day I got back, I ventured to answer a call coming through from the bank. A woman was on the line asking if she could verify some information. "Sure," I said, "go ahead" – thinking she would be asking a select three questions or so.

Seven questions in, I asked the person on the line if this was simply verifying who I am – in order to ask me something of a private nature, or disclose certain sensitive information to me – otherwise could she please explain exactly the purpose of what she was doing.

She explained that she just needed to "verify information", and kept going with the slew of questions. It dawned on me that she was simply reading off the form that I had filled in, under the beady eye of her colleague, who had verified, checked, prodded and generally made sure that all the information they needed was definitely there – and real, and original, and so on.

So I pointed out that I'd had face time with a colleague of hers – and he had seen all the original documents, has copies; we had gone over all this information, and had verified and reverified it then.

She then asked me whether he had seen my passport. I said surely she should be asking her colleague – not me – after all, I could claim he had, when he hadn't. By this point I was both thoroughly bored and conscious of time ticking by – time that could be put to good use – earning the money that would grease the wheels of my life, and the bank's coffers should I become a client.

The caller obviously had never had anyone ask what she was doing, why, and whether it made any sense. After all, my guess is that most people she calls are so desperate for a loan of sorts that they'd jump through whatever hoop was presented to have money released and available to them.

Let's think about this word "procedure".

Yes, there need to be systems and checks and balances in place.

But we also need to take a step back and see if it makes sense. In fact, how about exercising common sense at all times and occasionally manually overriding the nitty gritty – sometimes disabling process, in favour of actually getting things done in a timely, relatively pain-free manner?

The actual word we should be looking at is "compliance" – the reason this process is what it is.

Things have changed since the global financial crisis. The overriding aim is for history not to repeat itself (I have news for you: it will). And with this in mind, thousands of pages have been drafted for the world's banking community to adhere to in the name of compliance. How many people do you think have actually read the paperwork?

What we'll be told is that "bad" banks that don't want to invest in compliance will no longer be allowed to operate – and that we're all safer for it.

But here's a different view: What this means is that smaller banks that cannot afford to adhere to the new regulations will either go bust or be swallowed up by larger banks.

Large banks will pump resources into the ever-growing compliance department, and you and I will pay the price.

Overregulation means less return for banks, and more expensive banking for us.

The irony is that the quest to avoid another credit crunch is bringing about more people working in silos, which is how the credit crunch came about in the first place.

Here's to taking a step back, joining the dots, and making life a tad simpler. Now you must excuse me, there are some documents I must find …

Nima Abu Wardeh is the founder of the personal finance website cashy.me. You can reach her at nima@cashy.me

Follow us on Twitter @TheNationalPF

Let’s keep checks and balances in perspective

In the wake of the global financial crisis, the world's banking community is now obsessed with compliance. But it makes it a nightmare for the ordinary customer trying to take out a mortgage, writes Nima Abu Wardeh.

Most popular today