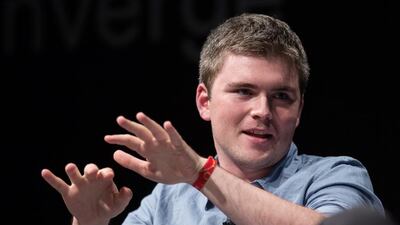

The Collison brothers

The brothers who cofounded online payments service Stripe have become Ireland’s youngest billionaires after a US$150 million funding round valued the business at $9 billion.

Patrick and John Collison own about 29 per cent of the business, based on an analysis of filings by private stock market Equidate. Bloomberg’s net worth calculation splits the founder ownership pool equally between the two, giving them each a $1.1bn stake.

The start-up’s surging valuation is based on its latest funding round disclosed on November 25, putting Patrick, 28, and his younger brother, John, among the likes of the co-founder of Snap, Evan Spiegel, and Uber’s Travis Kalanick in amassing a 10-figure fortune from a unicorn, a closely held start-up valued at $1bn or more.

Stripe provides software that lets businesses accept payments online from sources including credit cards and bitcoin as well as mobile services such as Android Pay and Apple Pay. It also provides tools to help with data security, fraud prevention, accounting and billing.

Founded in 2010, offering mobile payments tools for developers, Stripe’s first clients were small US technology companies. It has since become a competitor to digital payments giant PayPal, with clients that include Facebook, Target and Macy’s.

Sean Parker

Sean Parker decided to take on cancer by throwing so many tenets of research tradition out the window that he very nearly drove away the academics he wanted to attract.

Among the many curious things about the institute established by Mr Parker, Facebook’s first president and a co-founder of Napster, is that scientists must pledge to collaborate instead of compete and to concentrate on making drugs rather than publishing papers. Marketable discoveries will be group affairs, with collaborative licensing deals – no matter who led the research.

Many of the top cancer specialists who met in San Francisco to hear Mr Parker’s initial pitch three years ago were flummoxed as he explained profits would be distributed among all the institutions, though main inventors would get bigger shares and the Parker Institute for Cancer Immunotherapy would take a cut too. More than a few in the room at the Ritz-Carlton Hotel just couldn’t track how it would work.

Yet now there are more than 300 researchers on board and clinical trials are underway.

Mr Parker, whose net worth Bloomberg estimates at $3bn, started his institute with $250 million in seed money from his non-profit Parker Foundation. He said there is no point in going down well-trod roads. “The world is full of pretty stodgy foundations that generally do pretty safe things. I’d rather see what happens when you do something totally different that’s never been tried.”

It will be years before there’s evidence any of these experiments are bearing fruit. Mr Parker’s not sweating it. “The only thing I can be certain about is that if you listen to all of the people who would tell you how do it the conventional way, the outcome you’re going to get is kind of unexceptional,” he said.

Wilbur Ross

Wilbur Ross, the billionaire investor considered the “king of bankruptcy” for buying beaten-down companies with the potential to deliver profits, will be nominated as commerce secretary for the White House administration of his fellow billionaire, the president-elect, Donald Trump.

Reputed by Forbes to be worth nearly $3bn, Mr Ross would represent the interests of US businesses domestically and abroad as the head at Commerce. His department would be among those tasked with carrying out the Trump administration's stated goal of protecting US workers and challenging decades of globalisation that largely benefited multinational corporations.

With a Florida home down the road from Mr Trump’s Mar-a-Lago retreat, the 78-year-old played a role in crafting and selling the president-elect’s tax-cut and infrastructure plans. Mr Ross has suggested that much of America is disgruntled because the economy has left middle-class workers behind and says Mr Trump represents a shift to a “less politically correct direction”.

“Part of the reason why I’m supporting Trump is that I think we need a more radical, new approach to government – at least in the US – from what we’ve had before,” he told CNBC in June.

Mr Ross frequently commutes between his offices in New York and home in Palm Beach, Florida, according to Haute Living magazine. He maintains an art collection worth more than $100m that includes works by the Belgian surrealist Rene Magritte. As a graduate of Yale University, he pledged $10m to help build its management school.

For 24 years as a banker at Rothschild, Mr Ross developed a lucrative speciality in bankruptcy and corporate restructurings. He founded his own firm, WL Ross, in 2000 and earned part of his fortune from investing in troubled factories in the industrial Midwest and in some instances generating profits by limiting worker benefits. That region swung hard for Mr Trump in the election.

Alisher Usmanov

The Russian billionaire businessman Alisher Usmanov has been re-elected as president of the International Fencing Federation.

He was the only candidate at the congress in Moscow in late November and will start a new four-year term as head of the federation, known by its French acronym FIE. He has been president since 2008, investing millions of dollars from his fortune to promote the sport.

Mr Usmanov is close to the Russian president, Vladimir Putin, and is also a major shareholder in English football club Arsenal.

The FIE allowed Russia’s entire 16-strong team of fencers to compete in August’s Olympics in Rio de Janeiro despite the country’s doping scandal. Four failed drug tests in fencing had allegedly been covered up by Russian officials according to a World Anti-Doping Agency investigator, but FIE said none of those at the Olympics were implicated.

Forbes says his net worth of $14.4bn makes him the sixth-richest Russian. Leonid Mikhelson (gas and chemicals) ranks first at $17.5bn.

Lapo Elkann

Lapo Elkann’s Italia Independent Group, a maker of eye wear and lifestyle products, slumped to a record low on Nov 29 after the member of the billionaire Agnelli family was arrested in New York for making a false police report.

Italian Independent hit the new low in Milan trading after several US media outlets reported that Mr Elkann, 39, was arrested after he allegedly faked his own kidnapping after running out of cash in the city. A spokesman for the New York Police department said Mr Elkann was arrested for making a false police report regarding a claim of false imprisonment.

Mr Elkann, together with his siblings John and Ginevra, controls Exor, the Agnelli company that controls Fiat Chrysler Automobiles and Ferrari. His older brother John, chairman of Fiat Chrysler and Exor, oversees the family’s business investments.

Lapo, who also owns Garage Italia Customs, a company that customises cars, helicopters and yachts, was appointed to Ferrari’s board of directors in April. He doesn’t have a role in Fiat Chrysler or in Exor. At the eyewear company he is the controlling shareholder.

A grandson of the late Fiat chairman Giovanni Agnelli, Lapo Elkann left his job as head of brand promotion at Fiat in 2005 to enter a drug-rehabilitation clinic after health problems.

Lucio Tan

The Philippine tycoon Lucio Tan will consolidate his airline ventures as he focuses on expanding his flagship PAL Holdings and increase its appeal to potential buyers.

PAL will acquire another company owned by Tan called Zuma Holdings & Management through a share-swap agreement, valuing the whole deal at 8.24bn pesos (Dh609.4m), the company said in a stock exchange filing on December 2. The purchase will consolidate Philippine Airlines and budget carrier Air Philippines.

The New York Times in 1996 described Tan as "a billionaire legendary for his brazen business ways. But he also benefited from political cronyism reaching back to Ferdinand Marcos and Government-granted monopolies."

Forbes estimated his family’s net worth at $3.5bn.

The Petampai family

Millions of Thais need working capital for small businesses, but lack the credit history required by commercial banks. Firms such as Muangthai Leasing are vying to tap that demand. Sensing potential, investors have driven Muangthai Leasing’s shares have roughly quadrupled since the company listed in 2014, turning married founders Mr Chuchat Petaumpai and Mrs Daonapa Petampai into a billionaire family.

“There are a lot of areas in Thailand that have great potential for us to penetrate,” Mr Petaumpai, 63, said in an interview, adding that he expects strong earnings growth for at least the next couple of years.

The family’s fortune is valued at about $1.1bn, according to Bloomberg. Mr Petaumpai, the chief executive, and Mrs Petaumpai, the managing director, each own about 34 per cent of the company. Their sons, Parithad and Surapong, own smaller stakes.

Muangthai targets farmers and blue-collar workers, with motorcycles, cars and land used as collateral. These assets are more than enough to cover the debt, eliminating the need for a good credit history, according to Chuchat.

Mr Petaumpai said borrowers would rather pay off the debt than lose their collateral, adding collectors visit households swiftly if a payment is missed.

He has a master’s degree in finance from Oklahoma City University in the US. Early in his career, he worked as a loan officer at Thai commercial banks and finance companies. In 1992, he set up Muangthai in Phitsanulok province, north of Bangkok.

* Agencies

Follow The National's Business section on Twitter