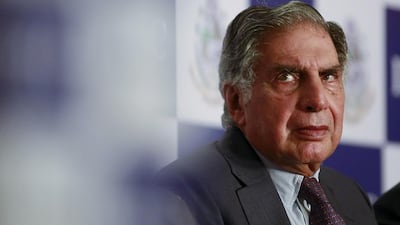

Who in their right mind would invest in the British steel industry? In 2007 India’s leading industrialist, Ratan Tata, did so to the tune of £6.7 billion (Dh48.8bn at the time) when he bought the Anglo-Dutch company Corus, which was basically all that remained of the once mighty British Steel and its Dutch equivalent Hoogovens. It was probably the worst deal ever done by an Indian company, and pretty high up the order for industrialists of any other nationality, too.

Today, faced with losses of £1 million a day, Mr Tata’s successors have announced the potential closure of its works in Port Talbot, South Wales, and have offered the rest of the corpse to whomever might be foolhardy enough to buy it.

For those who have not been following it, the future of Port Talbot, an emblematic symbol of Britain’s former industrial might, has become the hottest political issue in the United Kingdom in the past few weeks, forcing the prime minister David Cameron to cut short his Easter break to chair a series of crisis sessions to determine its future – if it has one.

The British government is now considering everything from slapping penal tariffs on Chinese imports to nationalisation.

Shortly after he had done the deal, I asked Ratan Tata why he bought Corus. We were in the bush in South Africa, attending a meeting of the International Advisory Board set up by the president at the time, Thabo Mbeki (Tata was on the board; I was a humble adviser). Was steel not, I asked him, a sunset industry, dogged by union issues, ferocious international competition and high costs?

That, he said firmly, was all out of date. The British steel industry, he asserted, after billions of pounds of state money had been poured into it, was a slim, super-efficient, highly profitable and technologically advanced industry that could take on the world. But he then confided something else.

The Tata family had been in the steel industry since the 1850s, starting in a small way in Gujarat but growing rapidly under his entrepreneurial ancestor Jamsetji Tata, the founder of India's most famous business dynasty.

When the British embarked on a major programme to extend the railways in the early 1900s, Ratan’s grandfather approached the British colonial official in charge and suggested that he provide some of the steel for the thousands of miles of track that would be needed.

The official, according to Tata, looked down his nose and replied: “Mr Tata, these railways will be built from the finest British steel made in Wales, Tyneside and Scotland. We don’t want your cheap, inferior Indian stuff.” Later, it turned out, there was huge corruption on the part of the British officials who bled the railways to the point of collapse by 1920.

Two generations later, Mr Tata took great pleasure in buying the whole – literally – of the British steel industry, and spent £2bn upgrading it.

It was not all he bought at the time: between 2000 and 2010 he embarked on a near-US$20bn acquisition spree, transforming his family’s business into one of world’s top conglomerates. He scooped up Tetley Tea and Jaguar Land Rover in the UK, New York’s Pierre Hotel and the South Korean lorry maker Daewoo.

But his most ambitious acquisition was Corus, which at the time was a successful FTSE 100 company, and he hailed it as “the first big step that Indian industry has taken in the international marketplace … as a global player”.

Last week his successor, Cyrus Mistry, convened a Tata board meeting in the old colonial building in Mumbai, where the industrial conglomerate has its headquarters.

The picture presented was a bleak one: Tata Steel’s debts stood at £7.9bn, Standard & Poor’s had downgraded its rating to junk status and there was a £15bn liability in the pension fund.

Worst of all, Tata, along with half the world’s steel industry, was being killed by impossibly cheap, subsidised Chinese steel that is being dumped on the global market in enormous quantities – China last year produced 803 million tonnes of steel and exported 105 million tonnes of it; the total British production by contrast was 15 million tonnes, down from a peak of 28 million tonnes in 1970. How do you compete with that?

The decision that emerged was to “restructure” Tata Steel in Britain, which basically meant the closure of Port Talbot’s blast furnaces, with the loss of up to 20,000 jobs, ending steelmaking in South Wales after more than 200 years.

After the meeting, an adviser was quoted as saying: “If Ratan Tata had been here today, I think the decision would have been very different”.

Mr Tata is a visionary and, in many ways, an industrial genius. The success he made of Jaguar Land Rover is stunning – last year it made a profit of £1.5bn, which is more than he paid for it. British Steel was a step too far. But the real culprits are the Chinese.

If they are not stopped, they will kill off steelmaking across half the globe. And that is in nobody’s interests.

Ivan Fallon is a former business editor of The Sunday Times.

business@thenational.ae

Follow The National's Business section on Twitter