Unmarried, 75, and with no heir to the empire, Ratan Tata retired as the chairman of the Tata Group at the end of last year to hand over the reins to Cyrus Mistry, only the second head in the company's history not to carry the family name.

It was considered the end of an era, as something that was left of the legacy of the group faded away. The sprawling conglomerate, first founded by Jamsetji Tata 145 years ago, is now made up of more than 100 companies with annual revenues exceeding US$100 billion (Dh367bn). In reality, it had long ago ceased to be a family-run business, with each of the companies having its own board of directors and shareholders.

Nevertheless, family businesses are still thriving in India, although analysts say that they may be forced to adapt to survive amid globalisation and as India's government opens its doors to more foreign direct investment (FDI).

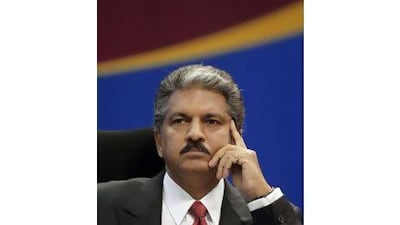

Family businesses make up about 95 per cent of all firms in India, according to estimates. The country's corporate landscape is dominated by a few major family names, including the Ambanis, which cover a whole spectrum of sectors ranging from groceries to mobile communications through the Reliance Group. Others are synonymous with particular industries, such as Mahindra & Mahindra, which is best known for its tractors, but also has interests ranging from finance to tourism. The Jindal family, meanwhile, is associated with steel, and the Ruia brothers of the Essar Group with energy.

"With globalisation, FDI, what is gradually happening - particularly with the progressive family businesses - they realise that they've got to give more empowerment to employees," says Ashish Arora, the founder and managing director of HR Anexi, a consultancy which works with a number of major family firms in India. "They realise that the family-run businesses have to really evolve for survival - otherwise they'll be washed out.

"You either fight, or flight, or collaborate. These are the only three options when you are faced with any adversity. There are some who are fighting out, who are evolving. There are some who will sell their companies and exit. There are some who will collaborate - they will make alliances, joint ventures."

He explains that many market driven issues naturally do not only affect major family-run firms, but adds that they can face additional pressure which arise from within.

"In family run companies, there are inside challenges and outside challenges," Mr Arora says.

"There can be a confusion between ownership and management. There are a lot of family run companies, they still wear both the hats of owner and manager. I think they have to distinguish themselves and say, 'I need my return on investment - let me hire a professional CEO or managing director to run the company'."

Arun Wakhlu is the executive chairman of Pragati Leadership. He agrees that many of the hurdles that family firms face are generated internally. "Whether they go corporate or whether they remain family run is a matter of choice," Mr Wakhlu says. "Some of the finest and most longstanding companies in the world are family run businesses, like in the Arabian Gulf, in the Middle East there are some."

Disputes can often be the downfall of a company.

"What happens in families is sometimes the lack of coherence and cohesion among family members in family businesses can become a challenge," says Mr Wakhlu. "For example, you can't fire an uncle of yours."

Many others have also highlighted this challenge.

"Indian family businesses form the 'backbone' of the Indian economy and hence there is a need to extend the life span of the family businesses so that the economy can continue to derive benefit from their contribution," according to the CII Family Business Network India Chapter.

"As new generations join the family business, it is an enormous challenge to keep the family and business together," the organisation says. "Some sacrifice the business to keep the families together, while others sacrifice the family to keep the business. It has been observed that just 13 per cent of the family businesses survive until the third generation and only 4 per cent go beyond the third generation and one third of business families disintegrate because of generational conflict."

Kamal Sen, the president and chief executive of the business consultancy Cogitaas, says that significant changes are already taking place in the large family firms.

"Firstly, they are moving to professional management rather than managing through family members," Mr Sen says. "Secondly, they are taking a sharp view on their competencies rather than being across many sectors and areas.

"Third, they are moving towards much larger scales, in the domestic market which does not have production limits any more, as well as in global markets," he continues. "Fourth, the competitive landscape for them now consists of new Indian entrants as well as large global firms entering Indian markets. Fifth, vibrant equity markets have now made this a key source of capital rather than depending only on public sector bank debt."

He believes that the traditional family-run business model is under threat.

"Global scale is now necessary, global scales will require large capital infusions, large capital infusions will lead to ownership dilution," says Mr Sen. "It is a process that has started and will continue."

Companies will have to overcome internal issues and adapt if they are to flourish amid a shifting local and global landscape, Mr Wakhlu explains.

"In family businesses there's a certain entrenched way of working.It's important because of globalisation to change the way we are doing things - to rethink, to innovate, to sometimes get rid of the old structures and create something new and fresh," he says.

"Another challenge is induction and training of talent of the next generation, grooming them up for the business roles, select them properly, coach them. These kind of challenges are peculiar to family businesses and therefore they have to take care of these more consciously."