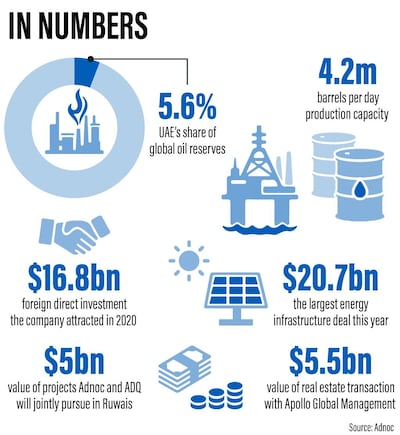

Throughout 2020, a challenging year for the energy industry globally, Adnoc worked to ensure the continuity of supply and reached a new milestone in output capacity, which surged to 4.2 million barrels per day in April.

Adnoc also forged a number of agreements with global asset managers across its value chain, which attracted $16.8 billion in foreign direct investment into the UAE, now ranked 19 globally in terms of FDI flows.

Midstream assets

In the midstream segment, Adnoc attracted a consortium of the world’s leading infrastructure and sovereign wealth funds to its gas pipelines earlier this year. The $20.7bn deal was the largest such transaction in the energy space this year.

The deal was significant as it happened during the height of the pandemic and showed the creditworthiness of Abu Dhabi and its low-cost and stable oil and gas assets to global investors.

Global Infrastructure Partners, Brookfield Asset Management, Singapore’s sovereign wealth fund GIC, Ontario Teachers’ Pension Plan Board, South Korea's NH Investment & Securities and Italy’s Snam are all investors in the assets. The transaction will unlock $10.1bn in foreign direct investment into the UAE.

Downstream investment

Apart from attracting international investors, Adnoc also created synergies in the downstream space with a number of prominent local entities. To spur development at its Ruwais hub, Adnoc and Abu Dhabi’s industrial holding company, ADQ have formed a joint venture, called Ta’ziz that will target investment in projects worth $5bn.

The JV will look to invest in chemical projects worth $3bn, with $2bn expected to be spent on the development of port and infrastructure facilities in Ruwais. Chemical compounds used in water treatment, metallurgy, agriculture, pharmaceuticals, adhesives and vehicles will be among the products shortlisted for further investment by the partners. The two companies are keen to direct foreign and local investors into the emirate’s Al Dhafra region.

The partnership will create job opportunities in the local economy and will drive investment flows into a number of ADQ entities, such as Emirates Steel, Etihad Rail, Ducab and Arkan.

Property

The Abu Dhabi company also signed an agreement worth $5.5bn with with Apollo Global Management to lease some of its property on a long-term basis, as part of its plans to unlock capital from non-core assets. The New York alternative asset manager and its subsidiaries will receive rental income from select Adnoc properties over a period of 24 years.

Direct upfront proceeds of $2.7bn will flow to Adnoc from the transaction. The deal proved to be an innovative way for oil and gas companies to monetise non-core assets.

New discoveries

Adnoc rounded off 2020 with plans to spend $122bn over the next five years, of which $43.5bn will be directed towards the local economy. The company also announced substantial recoverable unconventional oil resources onshore, estimated at 22 billion barrels. There was also an increase of 2 billion barrels in conventional oil reserves, which maintains the UAE's position as the holder of the world's sixth largest oil reserves. The country account's for 5.6 per cent of the world's proven oil reserves.

Alternative fuels

Abu Dhabi's biggest producer joined its global peers in its exploration for new and alternative fuels, as it pledged to lower its carbon emissions by 25 per cent over the next 10 years.

The group received the green light from Abu Dhabi's Supreme Petroleum Council to establish a 'hydrogen ecosystem' to meet growing global demand for the lighter, cleaner gas that is quickly emerging as a fossil fuel alternative.

Adnoc plans to ramp up production of hydrogen, which is already used in its downstream sector, to meet global demand for the gas and for ammonia derived from it.

Upstream exploration

Adnoc continued to expand on its core oil and gas assets, awarding a $519 million contract for onshore and offshore seismic surveys to BGP, a subsidiary of China National Petroleum Company. The scope includes the world's largest 3-D survey of hydrocarbon assets. Data from the survey will be used in exploration by partners from Adnoc's first licensing round. Successful bidders from the second licensing round will also be able to purchase data.