The coronavirus pandemic has accelerated the transition to greener and more environmentally friendly policies, with countries around the world looking at a record fall in emissions as a benchmark to set future sustainability targets.

A similar dynamic is unfolding in Dubai, where the emirate is studying the reduction in emissions from mobility restrictions put in place earlier this year to contain the pandemic.

Dubai saw a 22 per cent decline in carbon emissions last year and discussions about driving the growth of the renewables sector will take place at the annual Wetex and Dubai Solar Show, that runs for three days starting October 26.

Organised by the Dubai Electricity and Water Authority (Dewa), the event is taking place online this year. Some 168 solar companies from more than 1,000 businesses are participating in the virtual conference and exhibition.

The Middle East is home to some of the world's most ambitious planned solar schemes. Here are five of the biggest.

Mohammed bin Rashid Solar Park

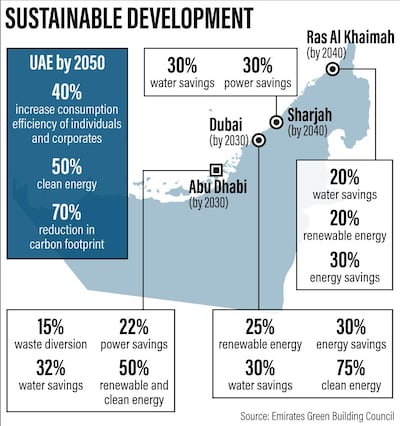

Dubai aims to generate 25 per cent of its energy requirements from renewable sources by 2030 and 75 per cent by 2050 as part of its clean energy drive.

Dewa is building the world’s largest solar energy park in an effort to reduce reliance on natural gas and diversify its power sources.

The Mohammed bin Rashid Solar Park is expected to generate 5,000 Megawatt of electricity by 2030 and is estimated to drive up to Dh50 billion ($13.6bn) in investment.

The fifth phase of the project is currently being implemented through Shuaa Energy 3, a firm in which Dewa holds a 60 per cent stake, with the remainder held by a consortium including Acwa Power and Gulf Investment Corporation.

Al Dhafra Solar Park

Abu Dhabi intends to generate half of its power requirements from clean energy sources by 2030.

The planned 2 Gigawatt Al Dhafra photovoltaic project comes after the start up of the 1.7GW Noor Abu Dhabi plant in June. Noor Abu Dhabi, built at a cost of Dh3.2bn, is a joint venture between Abu Dhabi National Energy Company (Taqa), Japan's Marubeni and China's Jinko Solar.

The tariff received on the Dhafra scheme, during the middle of the pandemic, is 44 per cent lower than that of the Noor Abu Dhabi project, the emirate's first solar PV scheme.

Ouarzazate Solar Power Station

The plant in Morocco, which is also known as the Noor solar power project, is a concentrated solar power scheme.

At 510MW, it is one of the biggest such schemes across the globe, with additional PV units expected to boost capacity to 582 MW. The $2.5bn project uses molten salt to store solar energy to produce electricity at night. The North African state is targeting 52 per cent of renewables in its energy mix by 2030.

Benban Solar Complex

Egypt's array of 41 solar power plants being developed in Aswan, home to Africa's second largest dam, is one of the biggest such PV schemes in the region.

The project has a nominal power capacity of 1,650MW at peak hour, making it the fourth largest such solar scheme in the world.

The Arab world's most populous nation is faced with rapidly growing demand for both industrial and residential power use. The country meets more than half of its power needs from gas at 53 per cent, with oil accounting for 43 per cent of its requirements.

The government is prioritising adding renewables to the mix, with plans to raise capacity from clean sources to 20 per cent by 2022.

Sakaka Solar PV Plant

The 300MW PV plant in Saudi Arabia’s northern Al Jouf region is the first of its kind for the world’s largest oil exporter.

The Sakaka plant, built at a cost of 1.2 billion Saudi riyals ($320 million) is part of the kingdom's plan to add 27.3GW of clean energy to grid by 2024. Saudi Arabia is also set to become the Middle East's biggest wind power market in the next decade.

The kingdom aims to account for almost half of the region's wind capacity additions by 2028. About 70 per cent of renewable schemes in the country will be backed by the sovereign investment fund, the Public Investment Fund, while the remainder will be awarded through the Renewable Energy Project Development Office within the Saudi energy ministry.