The Opec+ alliance of major crude exporting nations misjudged the impact of Iran sanctions on the oil markets and will remain wary of adding more volume to the markets again, according to the UAE energy minister.

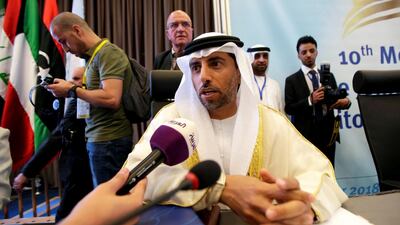

"I think we got a bit carried away with the fact that we took it for granted that those volumes were required by November,” Suhail Al Mazrouei told Bloomberg Invest conference in Abu Dhabi on Wednesday. "I think we struggled during the fourth quarter and we struggled in the first quarter despite the deal because of that decision,” he added.

Opec, led by Saudi Arabia, and producers outside the group led by Russia, reversed its 2017 pact to cut production and raised output as oil hit highs of $70 per barrel as well as to counter any loss of supply from Iran. The US imposed sanctions on Tehran’s energy industry in November but granted eight nations waivers to continue their imports.

The waivers cushioned the markets from the full impact of sanctions. Prices rose, hitting a peak of $86 per barrel in October before plunging to a third of that level the following month due to a flood of supply from Opec and US shale producers.

Opec+, as the group undertaking market corrections is known, eventually agreed in December to reverse the supply boost and pledged to undertake cuts of 1.2 million barrels per day for six months starting January.

“I think we have learned the lesson. We will do what is required to balance the market. We are not going to jump the gun, pre-produce the volumes that are not required yet,” the energy minister noted.

Asked if Opec+ still considered 1.2 million barrels per day credible in terms of production cuts, Mr Al Mazrouei said that may change if the market fundamentals change as well.

“Don’t get hooked to a number. We could have another number if the world supply and demand requires another,” he noted.

The minister said that Opec was not concerned about the price of crude but is focused on balancing the market and there’s a probability that the oil markets could reach balance by the end of the year.

On potential passing of the so-called No Oil Producing and Exporting Cartels Act (Nopec) introduced by a group of US legislators seeking to remove sovereign immunity from Opec states and their national oil companies, the UAE energy minister said that he has had several discussions with major oil producers on the subject who all agree that it is a bad idea.

“It doesn’t take a genius to think that you will lose money there…. it has helped US shale producers a great deal by boosting their production by balancing the market,” he said.

Reports earlier this week suggested that Saudi Arabia, the world’s biggest oil exporter plans to un-peg itself from the US dollar in retaliation to potentially vexatious Nopec bill.

However, both Saudi Arabia and the UAE on Monday shot down suggestions that they were considering moving away from trading their crude in dollars - a move that would have had wide ranging implications for the oil markets.