A US regulator on Thursday alleged a former oil chief executive tried to collude with Opec members to raise American petrol prices to increase his company's profits.

The complaint focuses on oil production in the Permian Basin, an oilfield between western Texas and south-eastern New Mexico.

Production increases from the basin largely contributed to huge oil growth last year in the US, when production averaged 12.9 million barrels per day.

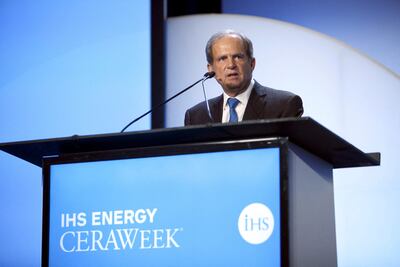

The Federal Trade Commission accused former Pioneer chief executive Scott Sheffield of trying to collude with Opec member countries to inflate oil prices by cutting production.

The accusation comes as the FTC indicated it would not block Exxon Mobil's $60 billion acquisition of Pioneer. The takeover is Exxon's largest in 25 years.

The commission accepted the agreement by a 3-2 vote.

The FTC said placing Mr Sheffield on Exxon's board as part of the acquisition would increase his contacts with Opec and the likelihood of co-ordination in that market.

“The dissent does not dispute that Mr Sheffield has tried to facilitate a cartel, nor does it suggest he will stop doing so after being elevated to the Exxon board of directors,” FTC chairwoman Lina Khan said in a statement.

As part of the agreement, he is banned from serving on Exxon's board.

“Mr Sheffield’s past conduct makes it crystal clear that he should be nowhere near Exxon’s boardroom,” Kyle Mach, deputy director of the FTC’s Bureau of Competition, said in a statement.

The FTC said Mr Sheffield's efforts were not just in the public sphere, but also in private conversations with high-ranking Opec representatives.

The US regulator said he “exchanged hundreds of text messages with Opec representatives and officials discussing crude oil market dynamics, pricing and output”.

In one exchange, Mr Sheffield tried to get Texas producers to reduce output.

“If Texas leads the way, maybe we can get Opec to cut production. Maybe Saudi and Russia will follow. That was our plan,” the FTC quoted him as saying.

The FTC claimed that by reducing output in the Permian Basin, Mr Sheffield hoped to raise US petrol costs and, therefore, company profits.

Matthew Bey, a senior global analyst at Rane Network, questioned how effective Mr Sheffield's information with Opec members might have been.

“They have their own incentive structures to cut or not cut production, and they may have got more information from him," Mr Bey told The National.

“But I don't know if it necessarily meant that there was a high degree of collusion in the sense that Sheffield had an equal impact on say, Saudi policy, or had a meaningful impact on Russian policy answers.

"The answer is probably not."

Mr Sheffield's efforts appeared to be unsuccessful, but the FTC said his appointment to Exxon's board may make it more likely that such efforts would be successful in he future.

Mr Bey believes the public message from the FTC should come as a warning to other US and western oil companies and executives.

"I don't know how much of a message it sends to Opec+ on this because they're essentially in many ways protected as sovereign entities," he said.

Under the agreement, no Pioneer employee or director, “other than certain named individuals”, can serve on Exxon's board for a period of five years.

In a statement, Pioneer said: "It was neither the intent nor an effect of Mr Sheffield’s communications to circumvent the laws and principles protecting market competition.

“Mr Sheffield and Pioneer believe that the FTC’s complaint reflects a fundamental misunderstanding of the US and global oil markets, and misreads the nature and intent of Mr Sheffield’s actions."

Exxon said it learnt about the allegations from the FTC.

"They are entirely inconsistent with how we do business," Exxon said.

It said the FTC "raised no concerns with our business practices" after the company submitted more than 1.1 million documents and 63,000 contracts to the regulator.

"We will close on May 3 and look forward to implementing the integration plans we’ve jointly developed with Pioneer over the past six months," Exxon said.