The global oil industry requires investments of $14 trillion, or about $610 billion per year, until 2045 to meet growing energy demand.

Out of the required amount, $11.1 trillion is needed in the upstream sector, while downstream and midstream requirements are estimated at $1.7 and $1.2 trillion, respectively, Opec said in its World Oil Outlook on Monday.

Last year, the group forecast long-term oil sector investments of $12.1 trillion to increase production and meet demand.

Energy demand worldwide is expected to expand by 23 per cent in the period to 2045, or about 3 million barrels of oil equivalent a day every year, the group said.

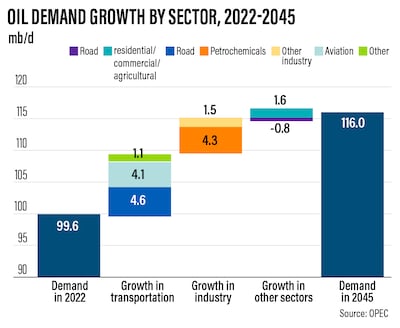

Opec raised its oil demand forecast for 2045 by 6 million barrels per day to 116 million bpd and said crude consumption could go “even higher”.

“Recent developments have led the Opec team to reassess just what each energy can deliver, with a focus on pragmatic and realistic options and solutions,” said Haitham Al Ghais, Opec secretary general.

“Calls to stop investments in new oil projects are misguided and could lead to energy and economic chaos,” Mr Al Ghais said.

“History is replete with numerous examples of turmoil that should serve as a warning for what occurs when policymakers fail to acknowledge energy’s interwoven complexities,” he added.

Opec said growth in primary energy demand will be driven by non-OECD (Organisation for Economic Co-operation and Development) countries, where consumption is set to increase by 69 million barrels of oil equivalent per day over the outlook period.

India, the world’s third-largest crude importer, will make up for more than a fifth of the non-OECD demand growth by 2045, the report said.

Demand for wind and solar is projected to record the biggest growth with an increase of 34.3 million barrels of oil equivalent per day amid strong policy support in many regions, Opec said.

The group expects the share of fossil fuels in the energy mix to drop to about 69 per cent in 2045, from more than 80 per cent last year due to a fall in coal demand.

The combined share of oil and gas in the energy mix would still represent 54 per cent, Opec said.

Global crude demand is set to reach 110.2 million bpd in 2028, up 10.6 million bpd from the group’s previous forecast. It is projected to further rise to 116 million bpd by 2045.

Opec’s share of global crude supply will increase to 40 per cent by 2045, from 34 per cent last year, it said.

Non-Opec oil supply is expected to rise to 72.7 million bpd in 2028 before gradually falling to 69.9 million bpd by 2045.

“With US liquids supply set to peak around the end of the current decade, overall non-Opec production starts declining from the early 2030s,” the report said.

“Guyana, Canada, Argentina, Brazil and Kazakhstan are some of the few non-Opec producers set to expand beyond the medium-term, but non-crude liquids including biofuels and other unconventionals will also keep increasing,” it added.

In June, the International Energy Agency said it expected global oil demand growth to slow significantly by 2028 as high prices and supply concerns hasten the shift to cleaner energy.

Based on current policies and market trends, crude demand will rise by 6 per cent between 2022 and 2028 to reach 105.7 million bpd, supported by strong demand from the petrochemical and aviation sectors, the Paris-based agency said in its medium-term oil market report.