A combination of Opec+ production cuts and strong demand from China, the world’s largest crude importer, is expected to push oil prices higher from next month.

But despite several bullish factors, Brent, the benchmark for two thirds of the world’s oil, is trading at roughly $76 a barrel, having lost nearly 11 per cent of its value since the beginning of the year

So why have prices not headed higher?

A combination of non-fundamental factors, lagging demand and stronger-than-expected supply are at play, according to Rystad Energy.

The Norway-based consultancy, which expects oil demand to grow by 1.7 million barrels per day this year, has estimated a deficit of 2.4 million bpd for the remainder of 2023.

“Much will depend on China’s economic performance in the second half of this year and the effectiveness of the country’s recently announced stimulus measures, and on the ability of the US and Europe to avoid an economic slowdown amid interest rates hikes,” said Jorge Leon, senior vice president at Rystad Energy.

Last week, oil prices posted a weekly gain as a surge in Chinese refining activity reassured traders that domestic fuel consumption was growing in the country.

China’s central bank also cut a key short-term lending rate for the first time in 10 months after disappointing economic data.

The People’s Bank of China lowered its seven-day reverse repo rate by 10 basis points to 1.9 per cent, from 2 per cent, as part of efforts to support economic growth.

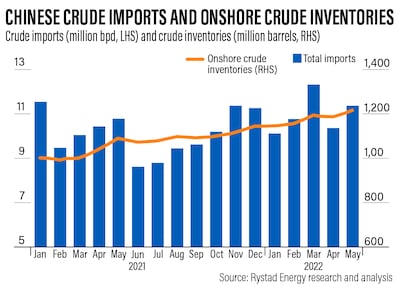

The country’s crude imports reached 12.3 million bpd in March before falling to 11.4 million bpd in last month, Rystad Energy said.

“These strong import numbers suggest oil demand remains solid; however, the caveat is that, at the same time, crude storage has been increasing in the last few months, which implies that demand is potentially lagging,” Mr Leon said.

On the supply side, there was a gap between Russia’s actual and promised production cuts in May, Rystad Energy said.

Moscow’s output declined by only 400,000 bpd last month, compared with its pledge to cut by 500,000 bpd, the consultancy said.

Russian oil exports hit 8.3 million bpd in April, the highest since Moscow’s invasion of Ukraine last year, the International Energy Agency said in its oil market report last month.

“The mismatch between Russia's production decline and increased seaborne crude exports is significant and puzzling,” Mr Leon said.

“The intriguing aspect is that if this ongoing disparity persists, with high exports and alleged production cuts, it could potentially lead to a significant shift in the supply dynamics and provoke a notable response from the rest of the Opec+ group,” he said.

On June 4, top crude exporter Saudi Arabia announced a unilateral output cut of 1 million bpd for July and said it could be extended.

The Opec+ alliance of 23 oil-producing countries has said it would stick to its existing output cuts until the end of 2024.

The group has total production curbs of 3.66 million bpd, or about 3.7 per cent of global demand, in place, including a 2 million bpd reduction agreed last year and voluntary cuts of 1.66 million bpd announced in April.

“The recent underperformance of energy commodities compared to other asset classes is primarily influenced by the macroeconomic environment and asset allocation decisions,” Mr Leon said.

“High interest rates and inflation have driven a shift towards safer assets, such as cash and bonds, due to recessionary fears and financial uncertainty.”

Last week, the US central bank paused its interest rate increases to assess the impact of its inflation-fighting measures on the economy, but signalled that it would raise rates again later this year.

Higher interest rates could slow the global economy and dampen crude demand. The Federal Reserve has raised interest rates by a combined 500 basis points since March 2022.

With declining inflation, the appeal of using commodities and particularly crude oil as an inflation hedge has diminished, Mr Leon said.

“As a result, speculative positioning on the oil basket has plummeted, reflecting a low level of confidence in tight physical markets in the coming months.”