S&P Global has identified key trends in the renewable energy sector this year, as the industry recovers from the effects of the pandemic and supply chain disruption.

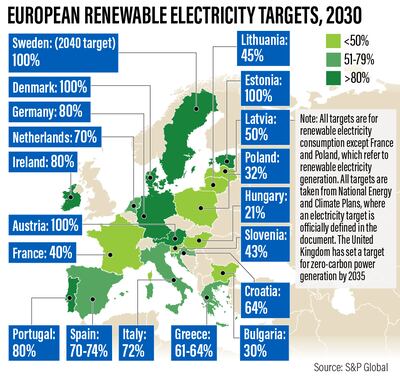

Renewable energy adoption underwent a significant boost last year due to the Ukraine war and the threat of potential oil and gas shortages, the rating agency said in a report on Tuesday.

Meanwhile, the US and the EU have unveiled their own green subsidies to boost investments in renewable technology.

A record 295 gigawatts of renewable energy capacity was added around the world last year, up nearly 10 per cent from the year before, according to the International Renewable Energy Agency (Irena).

Nearly half of all new renewable capacity last year was established in Asia, leading to a combined renewable capacity of 1.63 terawatts (TW). China, the world’s largest manufacturer of solar equipment, added 141 gigawatts to the continent's capacity.

Lower component prices will not lead to reduced capex

Solar, wind and storage equipment prices have fallen this year, thanks to lower raw material and shipping costs.

However, this will not affect the overall capital expenditure for renewable power systems as land access and grid connections remain the biggest bottleneck for the industry, S&P said.

Rising construction, labour and capital costs will also affect renewable power capex.

The rating agency said rooftop solar systems were unlikely to become “much cheaper” for end-users due to high demand, even as solar module prices ease from pandemic highs.

“Some of the drop will be offset by manufacturers seeking to recover margins. Further down in the value chain, installers and distributors will also raise their margins where possible,” the report said.

However, the fall in solar panel prices will benefit the utility-scale segment most, with global demand intensifying, particularly in cost-sensitive emerging markets, it said.

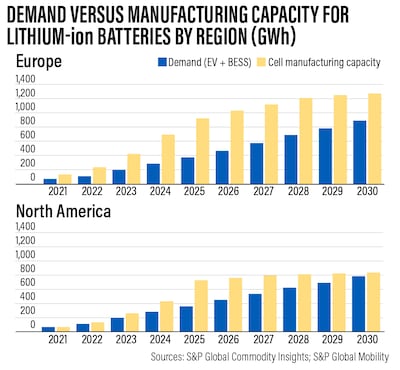

Local solar and battery manufacturing set to expand in US and Europe

China's dominance in renewable energy, particularly solar, has been the trigger for a new push to boost domestic manufacturing in the US and the EU, according to S&P.

The US Inflation Reduction Act, enacted last year, offers a series of tax incentives on wind, solar, hydropower and other renewables, as well as a push towards electric vehicle ownership.

Meanwhile, Europe’s REPowerEU plan aims to boost domestic manufacturing while rapidly reducing the region’s dependence on Russian exports.

Globally, the industry plans to build 500 gigawatts of wind, solar and battery energy storage this year, up 20 per cent from last year, S&P said.

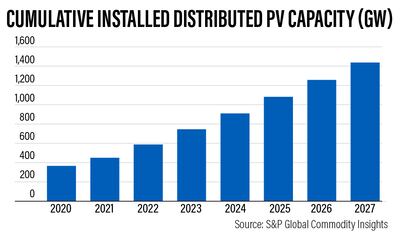

Distributed power to enter new sectors

S&P expects new types of households and small businesses to gain access to distributed solar this year as "shared solutions" become available.

Distributed generation refers to technology that generates electricity at or near where it will be used, such as solar panels and combined heat and power.

"Policymakers increasingly support distributed generation despite sending conflicting messages at times," S&P said.

"The introduction of electricity subsidies or price caps to offset consumer bills in developed markets may actually hold back some consumers that were considering investing in solar panels.

"The overall policy landscape will favour more distributed generation, either through cash grants, value-added tax reductions, tax rebates or feed-in tariffs."

US takes centre stage in hydrogen and carbon capture

The US federal policies have turned the country from a “laggard” to a “leader” in low-carbon hydrogen production, S&P said.

The combination of the Inflation Reduction Act’s multiple tax credits and the Bipartisan Infrastructure Law has set off a race for project development across North America, according to the rating agency.

The Bipartisan Infrastructure Law authorises up to $108 billion for public transport — the largest federal investment in public transport in the country’s history. It also includes $8 billion for the building of regional clean hydrogen hubs.

Inflation Reduction Act tax credits cover the entire hydrogen value chain and allow producers to stack credits, potentially making green hydrogen more affordable than grey, which is created from natural gas or methane, S&P said.

Nuclear makes a comeback

Nuclear projects are moving from Europe and North America to China, which is expected to have 53 per cent of the new nuclear build capacity until 2035, according to S&P.

While the US focuses on lifetime extensions with help from Inflation Reduction Act tax credits, the EU has added nuclear to its taxonomy of sustainable activities, enabling investors to label and market investments in them as green, the rating agency said.