Adnoc could raise more than Dh7.46 billion ($2 billion) from the sale of a 4 per cent stake in its gas business through an initial public offering on the Abu Dhabi Securities Exchange.

The state energy company will sell more than three billion shares in Adnoc Gas, and has set the offering share price between Dh2.25 and Dh2.43 a share, implying an equity value of $47 billion to $50.8 billion, it said on Thursday.

The final offer price will be determined through a book-building process and is expected to be announced on March 3.

The subscription period for UAE retail investors starts today and runs until March 1, while the book-building period for qualified investors starts today and runs until March 2.

Abu Dhabi Pension Fund, Alpha Wave Ventures II, LP, IHC Capital Holding, OneIM Fund I LP and entities controlled by ADQ and the Emirates Investment Authority are set to — directly or indirectly — become cornerstone investors in the IPO, with a combined commitment of $850 million.

The listing of the gas processing and marketing unit is the UAE's biggest IPO this year and the company expects to start trading on the ADX on March 13.

Adnoc Gas has access to 95 per cent of the UAE's natural gas reserves, estimated to be the seventh largest globally. The company also supplies more than 60 per cent of the UAE's gas needs.

It will operate eight gas processing sites and a pipeline network of more than 3,250km.

Adnoc Gas plans to pay $3.25 billion in dividends in 2023, split in two payments. It intends to increase the annual dividend amount by 5 per cent from 2024 to 2027.

The parent company will continue to own 91 per cent of the company after the IPO.

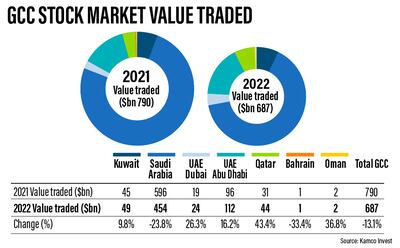

With high inflation, uncertainty surrounding the world economy, rising interest rates and the war in Ukraine, Gulf capital markets stood out from their global peers in 2022, benefitting from higher oil prices, a boost of liquidity and stronger investor confidence.

Middle East IPOs raised more than $23 billion in 2022 from 48 listings compared with $7.52 billion raised from 20 offerings in the previous year.

That was the highest share for the Gulf region after 2019, when Saudi Aramco went public in a $29 billion offering, the world’s largest.

The UAE had 12 listings that raised $11 billion last year, apart from the joint Abu Dhabi-Riyadh listing of Mena food franchisee Americana, which reaped $1.8 billion in late 2022.

The GCC will continue to attract IPOs in 2023, despite the challenges facing the global economy, with 27 to 39 companies possibly floating their shares, according to Kuwait's Kamco Invest.

The Abu Dhabi Securities Exchange was the best-performing market in the GCC for the second consecutive year in 2022, gaining more than 20 per cent.

Its market capitalisation stood at more than Dh2.53 trillion on Thursday.

First Abu Dhabi Bank and HSBC are acting as joint global co-ordinators on the Adnoc Gas offering, while Moelis & Company has been appointed as independent financial adviser.

Abu Dhabi Commercial Bank, Arqaam Capital, BNP Paribas, Deutsche Bank, London Branch, EFG-Hermes and International Securities have been appointed as joint book-runners.

First Abu Dhabi Bank is the lead receiving bank while Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank and Al Maryah Community Bank have been appointed as receiving banks.