European power tariffs have been declining thanks to mild weather and natural gas prices falling to multi-month lows.

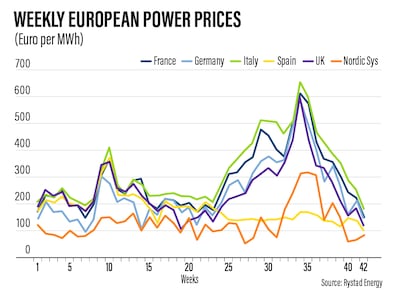

Last week, the UK saw the largest decrease in electricity prices since the peak in late August, with an 81 per cent fall, Norway-based consultancy Rystad Energy said on Monday.

Prices in France fell by nearly 34 per cent, with rates in Germany “appreciably” down, said Rystad.

For months, European leaders have been dealing with the prospect of losing Russia’s natural gas supply, which accounts for about 40 per cent of European imports and has been a crucial lifeline for the continent.

Tariffs across the region were well below €200 ($197.53) per megawatt hour, ranging from less than €100 per MWh in the Nordic countries to €181 per MWh in Italy.

Russia, Europe's biggest natural gas supplier prior to its conflict with Ukraine, has curtailed exports to the region. This, along with a heatwave, pushed the region's electricity prices to record highs of €1,500 per MWh in the summer and weekly averages of around €600 per MWh in Italy, Germany, France and the UK.

“The gas market continues to be the main driver for reduced power prices, in addition to soft demand fundamentals and solid renewables generation in recent weeks”, Fabian Ronninge, senior analyst at Rystad Energy, said.

The price of the Dutch Title Transfer Facility (TTF) gas futures, the benchmark European contract, fell to an intraday low of about €93.35 per MWh on Monday, down roughly 18 per cent from Friday’s closing price of €113.58, the lowest since mid-June.

There is “potential” for further decline in power prices this week as gas storage levels rise, said Rystad.

The risk of Moscow cutting gas supplies during the peak winter season has prompted the EU to boost its gas reserves in the short term.

Total European underground storage is beginning to “flatten out” but is still increasing overall, said Rystad.

Storage levels reached 92.8 per cent across Europe on October 21, the highest level since November 2020, it said.

Germany, Italy, France, the Netherlands and Austria make up two thirds of the EU’s total capacity.

Imports of liquefied natural gas (LNG) continued to be “very strong” in October as countries scramble to secure alternative power sources ahead of the winter, said Rystad.

So far in October, France is leading Spain and the UK as the largest LNG importer in Europe.

The EU, the largest LNG importer in the world, brought in about 30 billion cubic metres of LNG worth almost €33 billion in the first quarter of 2022. The US has become the region’s biggest LNG supplier, representing almost half of the total imports.

Coal prices, which surged earlier this year due to Russia-Ukraine trade disruptions and shortages in China, have declined in recent weeks due to a large increase in domestic coal production in the world's second largest economy.

This has reduced Chinese imports and freed up more supply to other regions, said Rystad.

The API2 front-month benchmark for European hard coal prices has dropped more than 30 per cent since the start of September.

Germany, which has been boosting its coal-fired power generation to save gas, plans to bring back seven additional gigawatts of lignite and hard coal capacity for the winter to alleviate some of the pressure in the power market.

The move is expected to save up to 30 terawatt-hours of gas in the power market, said Rystad, citing European energy news provider Montel News.