Oil fundamentals are expected to tighten further as sanctions by the EU on Russian oil exports slowly take effect, squeezing supply even as demand gradually picks up, a new report by UK consultancy Energy Aspects has said.

Brent, the global benchmark for two thirds of the world's oil, is closing in on "key technical levels", with refinery demand set to accelerate further by the end of May, which will push crude higher, the report said.

"We expect forward product prices to continue rolling up with growing demand. Upstream maintenance across the US and North Sea will also further tighten balances," it said.

Even as the EU moves towards an oil embargo and a ban on shipping insurance for vessels carrying Russian fuel to non-EU destinations, prices have remained "relatively subdued", mainly due to concerns about the health of the Chinese economy, given its Covid-19 restrictions.

Brent was trading 0.30 per cent higher, at $112.40 a barrel at 6.25pm UAE time on Friday, while West Texas Intermediate, the gauge that tracks US crude, was up 0.26 per cent to $112.50 a barrel.

Crude prices rose to a notch under $140 per barrel in mid-March after the US and its allies imposed sanctions on Moscow in response to its military offensive in Ukraine. However, prices have been trading lower in the past few weeks amid demand concerns, due to movement restrictions in some cities in China, as the country pursues its zero-Covid policy.

This week, prices started to rise again as China, the world’s largest importer of crude, began easing restrictions in Shanghai.

While the "unwinding of Covid-19 restrictions in Shanghai has been more grinding than expected, and remains prone to pockets of deterioration", the overall situation is improving and infrastructure spending is rising sharply, which will show up in data from the third quarter, Energy Aspects said.

Chinese oil demand losses will not offset declines in Russian supplies, it said.

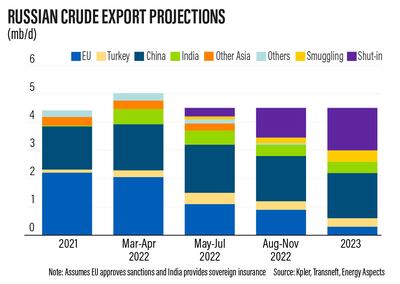

Russian crude and products exports could fall "precipitously" from August if the EU approves the proposed insurance ban for ships carrying Russian oil.

Many investors are waiting for clear data from Russia to confirm supply figures but official information from Moscow has been scant, the report said.

"Our analysis, based on observed gas flaring at Russian oilfields, suggests production averaged 9.75 million barrels per day in April (-1.33 million bpd versus February). Non-routine flaring increased in March but faded away in April, suggesting emergency shutdowns," Energy Aspects said.

Russia accounted for about 45 per cent of EU gas imports and close to 40 per cent of its total gas consumption in 2021, figures compiled by the International Energy Agency indicate.

Europe currently receives 2 million bpd of Russian crude, the Energy Aspects report said, and under its sanctions package, the EU plans to halt imports of crude within six months and products within eight.

But the proposal to prohibit European companies from providing insurance or other assistance to transport Russian oil to any non-European destinations, as well as explicitly prohibiting European-flagged or owned vessels from carrying Russian-origin oil, will also have a major effect on the market, the consultancy said.

These measures, which are likely to come into effect by August, could "severely impact Russian exports to other regions". That is because 95 per cent of tanker insurance is arranged by the International Group of P&I Clubs, which, although based in the UK, is affected by EU sanctions because many members are European insurers, the report said.

Since March, 1.8 million bpd of Russian waterborne crude and 1 million bpd of products left for non-EU countries, including Turkey.

"Even assuming China uses its own vessels and India provides sovereign insurance, a significant chunk of the 2.8 million bpd of liquid flows to non-EU destinations will be at risk once the insurance ban takes effect," Energy Aspects said.

Last month, Opec also lowered its supply forecasts for 2022 due to market uncertainty.

Non-Opec supply in 2022 is forecast to fall by 300,000 bpd to 2.7 million bpd due to a decline in supplies from Russia after sanctions, said the group, which represents some of the top oil producers.

Meanwhile, global demand will rise by 3.67 million bpd in 2022, down 480,000 bpd from its previous forecast, Opec said.

Total consumption is expected to surpass the 100 million bpd mark in the third quarter, as predicted previously by the oil group.