Live updates: follow the latest news on Russia-Ukraine

Oil prices remained above $120 a barrel on Tuesday after hitting a 14-year high yesterday, with Russia issuing a warning that it retains the option to cut natural gas supplies to Europe through the Nord Stream 1 pipeline if the US and its EU allies ban its crude imports in response to its military offensive in Ukraine.

Such a move would shake energy markets further and exacerbate inflationary pressures globally.

Russia could stop the flow of gas through pipelines from the country to Germany after Berlin decided to stop the opening of the new Nord Stream 2 pipeline, Russian Deputy Prime Minister Alexander Novak, who is also in charge of energy affairs said in a televised speech on Monday.

“We understand that in connection with the unfounded accusations against Russia regarding the energy crisis in Europe and the imposition of a ban on Nord Stream 2, we have every right to take a mirror decision and impose an embargo on gas pumping through the Nord Stream 1 gas pipeline,” Mr Novak, who was previously Russia’s energy minister, said.

“So far, we are not making this decision. No one will benefit from this. Although European politicians are pushing us to this with their statements and accusations against Russia,” he said.

A ban on Russian crude — which the US announced it is considering on Monday and which led to oil prices hitting their highest since 2008 at the start of trading this week — “would lead to catastrophic consequences for the global market”, Mr Novak said.

He said oil prices could soar to $300 a barrel or more.

The US move is part of Washington's strategy to try to freeze the world's second-largest energy exporter out of global markets and isolate Moscow economically for its military offensive in Ukraine.

Russia supplies about 40 per cent of Europe's gas while its crude accounts for about 3 per cent of US oil imports, equal to about 200,000 barrels a day.

“To date, the West’s financial sanctions against Russia have not proved effective in de-escalating the conflict in Ukraine,” said Rystad Energy’s senior oil market analyst Louise Dickson.

“Expanding sanctions to include physical commodities, including Russian oil exports, is definitely on the table. The impact of a US unilateral ban would be minimal.”

Oil prices soared above $130 a barrel in early trading on Monday after the US said it was considering banning Russian crude imports and holding discussions over such a move with European allies.

Brent, the global benchmark for two thirds of the world's oil, hit $139.13 a barrel and West Texas Intermediate, the gauge that tracks US crude, jumped to $130.50 in early trading Monday.

Both key benchmarks receded later on Monday but remained high on Tuesday, with Brent up 2.90 per cent at $126.8 a barrel at 4.20pm UAE time and WTI trading 2.45 per cent higher at $122.3.

“If the US can encourage Europe to participate in the embargo, the continent would be blocking about 3.8 million bpd monthly [on] average of Russian crude imports. The EU agreeing to an outright ban on Russian oil is unlikely given its members' dependence on the fuel,” Ms Dickson said.

Jeffrey Halley a senior market analyst at Oanda said “the reality is, that 7.5 million bpd of Russian exports, or even part of it, cannot be replaced in an already tight international market".

The surge in oil prices to their highest level since 14 years on Monday exacerbates inflationary pressures globally and the International Monetary Fund has said the Russia-Ukraine conflict could have a “severe impact” on the global economy.

The UN index of food prices increased 4 per cent in February from January this year and was up 24 per cent from the same month a year ago, marking a record high.

Gold, the precious metal that is a traditional safe haven and hedge against inflation, jumped up to $2,026.1 an ounce on Tuesday on the Chicago Board of Trade (CBOT) at 11.55am UAE time.

Wheat futures on the CBOT rose more than 4 per cent on Tuesday to $13.37 a bushel. Combined, the Ukraine and Russia export 29 per cent of the world’s wheat through the Black Sea, where many shipping firms have suspended operations after attacks on cargo ships.

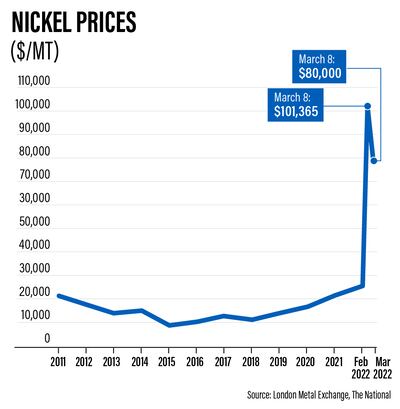

The price of nickel — which is used in boat propeller shafts, turbine blades, batteries, including nickel-metal hydride batteries for hybrid vehicles — more than doubled on Tuesday for the first time ever to $101,365 a tonne, before falling back to about $80,000, prompting the London Metal Exchange to suspend its trading. Russia is the world's third biggest producer of nickel and accounted for about 11.3 per cent of total nickel output in the world in 2020.

"Fears over nickel supply disruptions following Russia-Ukraine conflict continued to be aggravated, inciting extensive buying," said Rystad Energy analysts Marina Bozkurt and Susan Zou.

In a statement on Tuesday, the LME said it will "actively plan for the reopening of the nickel market, and will announce the mechanics of this to the market as soon as possible". The exchange said it will consider "a possible multi-day closure, given the geopolitical situation which underlies recent price moves."

The surge in the price of nickel cornered brokers who had to pay margin calls against short positions, affecting the largest nickel producer as well as a major Chinese bank, Bloomberg reported.

"The rise in inflation seems to be the biggest worry that investors are facing, while the outlook for growth is turning negative by the day," said Naeem Aslam, chief market analyst at Avatrade.

"This development is dragging investor sentiment down and adversely affecting all sectors. This is why, even when the stock prices of companies decline, stock traders seem to no longer be interested in purchasing the dip."

Germany’s DAX dropped 2 per cent on Monday, France’s CAC was 1.3 per cent weaker and the UK’s FTSE 100 slipped 0.4 per cent.

The S&P 500 was about 3 per cent lower at the close of trading on Monday and is down about 11.9 per cent year to date. The Nasdaq tumbled 3.62 per cent, extending it's decline since the start of the year to 18 per cent. The Dow Jones Industrial Average retreated 2.37 per cent and is down 9.7 per cent year to date.

Japan's Nikkei 225 was about 2 per cent lower on Tuesday at 10.12am UAE time.