Amanat Holdings, the Dubai-listed firm which specialises in investments in healthcare and education sectors, said on Thursday it has increased its stake in UAE K-12 primary and secondary education Taaleem Holdings to 21.7 per cent, becoming its largest investor.

The company bought an additional 5.3 per cent stake in Taaleem for Dh52 million, after acquiring a 16.34 per cent holding for Dh146m in April last year.

“Taaleem Holdings was our first investment in the education sector in the UAE, and we were always keen on increasing our stake in it at the right price as we firmly believed in its model and positioning,” said Hamad Al Shamsi, chairman of Amanat Holdings. “Taaleem’s like-minded management team also complements our approach to growing the business and the development of the UAE Education sector.”

The UAE plans to beef up its education sector as part of efforts to have qualified individuals seeking employment and to attract more international students to its schools and universities. The total number of school students in the UAE is projected to grow at an annualised rate of 4.1 per cent, from an estimated 1.1 million in 2015 to 1.4 million in 2020, according to Dubai-based investment bank Alpen Capital.

_____________

Read more:

UAE's Amanat third quarter net profit surges 15.2%

Exclusive: Amanat may seek listing of portfolio companies in next two to four years

_____________

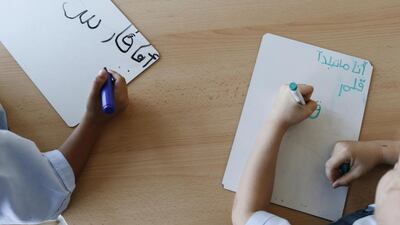

Taaleem Holdings, a provider of early childhood, primary and secondary education, currently operates through ten facilities (seven schools and three nurseries) in the UAE and has a capacity of 11,000 students with current enrolment figures of around 9,000 students. It offers education across multiple curricula, including British, American and International Baccalaureate, as well as a multi-lingual early childhood programme.

“Our focus for the coming months will be to continue working closely with the Taaleem team to expand student enrollment and capacity and drive growth for the company,” said Shamsheer Vayalil, vice chairman and managing director of Amanat. “This is in line with our distinctive collaborative investment model that allows us to continue growing our partners’ businesses, while generating sound returns for investors and shareholders alike.”

Amanat recorded a 15.2 per cent jump in the third quarter net profit to Dh14.9m, helped by an increase in income from associates in the UAE and Saudi Arabia.

Amanat has so far made one exit from investments when it last year sold its stake in in Abu Dhabi-based Al Noor Hospitals.

The portfolio companies of Amanat are getting closer to being ready for initial public offerings (IPOs) and may seek listings on regional stock exchanges within two to four years, its former chairman Faisal Bin Juma Belhoul told The National in October.

A decision to where to list the companies will depend on the nature of the business, the market and investors’ appetite at the time of listing, Mr Belhoul said.

As its portfolio continues to mature, Amanat is looking to invest its entire Dh2.5 billion capital before the end of 2018, pursuing more acquisitions in the UAE and Saudi Arabia. It will invest Dh1bn within the fourth quarter of 2017 on “more than one deal” in both health and education sectors, Mr Belhoul said.