The value of the UAE’s retail e-commerce market rose 53 per cent to a record $3.9 billion in 2020, largely driven by the digital shift in consumer shopping habits amid the Covid-19 pandemic, according to a new report by Dubai Chamber of Commerce and Industry.

The study, based on data from Euromonitor, projected the market value of the online retail e-commerce market will reach $8bn by 2025. The growth will be supported by high incomes, high internet penetration, developed transport logistics, modern digital payment systems, a tech-savvy youth and strong government support, according to Dubai Chamber.

E-commerce accounted for 8 per cent of the UAE’s overall retail market last year, the report added.

Online shopping became more popular after governments across the world introduced movement restrictions to stop the spread of the Covid-19 pandemic.

E-commerce sales in the Middle East and North Africa region are set to triple to $28.5bn next year, from $8.3bn in 2017, according to research by Bain & Company and Google.

Dubai Airport Freezone Authority (Dafza) launched the first phase of Dubai CommerCity, a Dh3.2bn ($871.1 million) dedicated e-commerce free zone in Umm Ramool, in April this year to tap into the rapidly growing e-commerce sector in the region.

The UAE e-commerce sector was responsible for the highest number of licences (196) in May last year, according to data from the UAE National Economic Register.

With the UAE boasting the highest smartphone penetration rate in the Mena region, the share of mobile commerce increased to 42 per cent in 2020 from 29 per cent in 2015, the study said.

“In 2020, the value of the UAE’s retail m-commerce market reached $1.6bn, 56 per cent higher than the previous year. The UAE’s retail m-commerce market is projected to reach $3.9bn by 2025 and grow at a CAGR [compound annual growth rate] of 18.9 per cent between 2020 and 2025,” the report added.

Although challenges, such as cash on delivery, persist in the UAE e-commerce market, the share of this payment method shrank slightly during the Covid-19 pandemic due to hygiene measures and the development of contactless payments, the report found.

Other challenges include high costs faced by online retailers.

“Apart from picking, packing and delivery cost, one of the biggest costs is high returns of products. Experts have found that people return 15 per cent to 40 per cent of what they buy online, compared with 5 per cent to 10 per cent for in-store shopping,” according to Dubai Chamber.

However, product returns are expected to decline with “improvements of online product details, customer support and visualisation”, the report said.

Meanwhile, consumer spending in the UAE is forecast to grow 3 per cent this year to $146bn, before picking up pace to a CAGR of 4.3 per cent over the next five years to $175bn, according to Euromonitor.

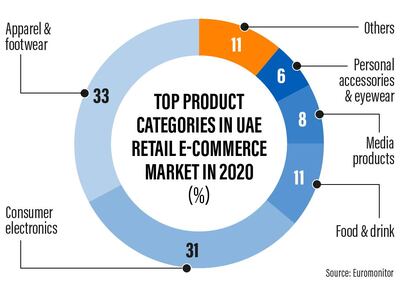

The apparel and footwear category accounted for the highest share (33 per cent or $1.3bn) of the UAE retail e-commerce market in 2020.

Consumer electronics accounted for 31 per cent ($1.2bn) of the market. In this category, demand was high for laptops, personal computers and tablets due to remote working and online education during pandemic-induced movement restrictions, according to Dubai Chamber.

Food and drink accounted for 11 per cent ($400m) of the UAE retail e-commerce market last year.

Retail e-commerce sales of food, drink and consumer electronics products recorded triple-digit growth during the Covid-19 pandemic, according to Euromonitor. Other product categories which recorded more than 50 per cent growth in sales include beauty and personal care, pet care, and apparel and footwear, the chamber said.

The fastest-growing product in the UAE e-commerce market is expected to be personal accessories and eyewear, with a CAGR of 20 per cent from 2020 to 2025, followed by media products, pet care and home care products, the report found.

“E-commerce trends expected to gain momentum with consumers include quicker, safer, more intuitive and personalised experiences, voice-activated shopping, contextual and social commerce, virtual instant reordering and product subscriptions combined with conveniences such as same-day delivery and competitive pricing,” the chamber said.