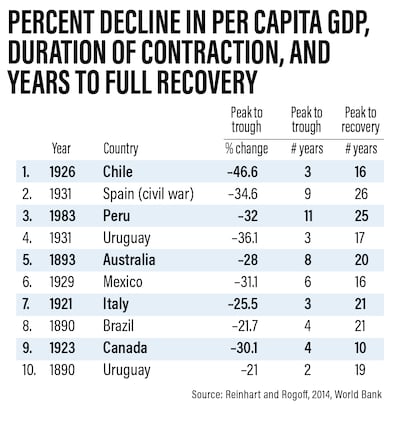

Lebanon’s economic crisis, the country’s worst in three decades, is expected to rank among the world’s top 10 crises – possibly even the top three – since the mid-19th century, according to the World Bank.

The magnitude of the economic depression has "no clear turning point" on the horizon, given the "disastrous" and deliberate policy inaction, the Washington lender said report. Lebanon's gross domestic product has plunged to an estimated $33 billion in 2020, from nearly $55bn in 2018.

Gross domestic product fell to about $33 billion last year, from about $55bn in 2018.

“Such a brutal and rapid contraction is usually associated with conflicts or wars. Even prior, the World Bank has long identified Lebanon as a fragility, conflict and violence state, and as such, the dire socio-economic conditions risk systemic national failings with regional and potentially global consequences,” the lender said.

The already dire social effects of the crisis could rapidly become catastrophic, with more than half the population probably below the national poverty line, the lender said in its Spring 2021 Lebanon Economic Monitor.

Phone surveys conducted at the end of last year by the World Food Programme found that 41 per cent of households reported challenges in securing access to food and other basic needs, the World Bank said.

The share of households that experienced difficulty in obtaining access to health care rose to 36 per cent in the November to December period, from 25 per cent between July and August.

Unemployment among the respondents increased to about 40 per cent from November to December, compared with 28 per cent in February.

A report by the lender last year said the country was in a "deliberate depression" due to the political paralysis and a failure by policymakers to reach an agreement on a new government and the necessary reforms that could unlock billions of dollars of aid from the International Monetary Fund and international donors.

Lebanon is in the grip of its largest peacetime economic and financial crisis, compounded by the Covid-19 pandemic, the Beirut port explosion and inadequate policy responses amid more than a year of political infighting.

The economy shrunk by 20.3 per cent last year, after a 6.7 per cent contraction the year before, according to the lender.

The contraction in Lebanon’s real GDP per capita is already worse than any of the G8’s peak-to-trough changes. The country’s debt-to-GDP ratio is estimated to have reached 174 per cent last year, according to the bank.

The Lebanese pound has plunged more than 80 per cent against the US dollar on the black market and inflation hit 158 per cent in March this year.

A deadlock over the Cabinet formation since October over disagreements on the number of ministers, distribution of portfolios and veto power in line with the country’s sectarian power-sharing system has also raised the spectre of violence.

Lebanon has had three notable periods of civil strife in its history – the first dating back to the 1860s, the second in the 1950s and third, which started in 1975 and lasted 15 years.

The economic crisis “has exacerbated long-term national deficiencies including institutional weaknesses, failed economic and social policy and dismal public service delivery. In such an environment, there is growing weariness of triggers for social unrest”, the lender said.

The World Bank said the country's foreign exchange subsidy for imports of critical and essential goods presents a serious political and social challenges as more vulnerable households are exposed by the decline of their purchasing power.

The crisis is affecting public services such as electricity and water provision, sanitation and education. Rising poverty levels have driven up the number of people that are dependent on public services, threatening Lebanon's financial viability and ability to operate due to the higher costs and lower revenue, the bank said.

The liquidity crunch and lack of foreign currency could result in the termination of private sector contracts for power plant maintenance and temporary power generation, it said.

Power utility Electricite du Liban, which costs the government $2bn annually, is expected to increase the number of power cuts to manage its cash flow, the World Bank said.

As a result of reduced water supply from the country’s utilities last year, people have had to rely on costlier and less convenient alternatives such as water tankers and bottled water, whose prices have surged, it said.

“The breakdown in sanitation services risks intensifying the spread of water-borne diseases", adversely affecting an already vulnerable public health system, the bank said.

The compounded crises have placed the country’s education sector under severe strain and the increase in poverty rates is forcing students to drop out of private schools and enrol in public ones.

About 54,000 students, 11 per cent of public sector students, have left the education system this year, the bank said. Most are from the most marginalised households.

In December, the Institute of International Finance said to introduce real reforms was pushing the country's economic trajectory towards that of a "failed state".