Iraq's economy is on the brink of collapse as the Covid-19 pandemic and dwindling oil revenue bite, necessitating the implementation of critical reforms, analysts say.

Opec’s second-largest producer could see its economy shrink 12.1 per cent this year, the third-steepest contraction in the Arab world after Lebanon and Libya, according to the International Monetary Fund.

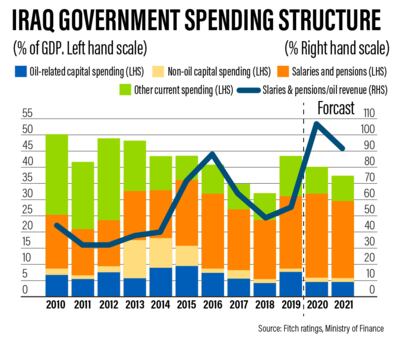

The country depends on oil revenue to meet 90 per cent of government expenditure, including $5 billion spent on monthly salaries for public servants. That leaves the government with difficult decisions that could raise the prospect of further civil strife.

A white paper on economic reform submitted to parliament by Mustafa Al Kadhimi's government proposes slashing the bill for government salaries to 12.5 per cent of gross domestic product within three years, from the current 25 per cent. The paper also calls for a reduction in benefits and allowances as well as reforms to the pension system.

Recommendations include phasing out subsidies to critical sectors in Iraq's economy, notably power.

"Electricity subsidies are one of the largest,” said Ahmed Tabaqchali, chief investment officer at the AFC Iraq Fund and a fellow at the Kurdistan-based Institute of Regional and International Studies. "They probably cost somewhere up to 4 per cent of GDP.”

He sees the current government including recommendations made in the white paper in Iraq’s 2021 budget.

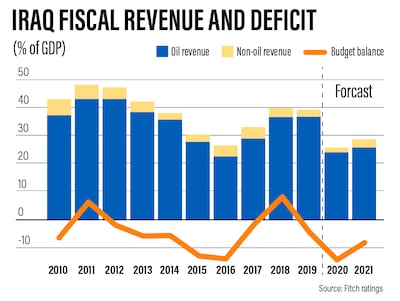

Implementing long-term structural reforms remains a challenge for Iraq because it desperately needs oil revenue to balance its books at a time when it remains under pressure to curb supply as a member of the Opec+ alliance.

Iraq had already agreed to make compensatory cuts for overproduction earlier in the year, but output and exports have surged since September, putting it in an uncomfortable position at the upcoming Opec+ meetings.

The alliance headed by Saudi Arabia and Russia will convene their joint ministerial monitoring committee today and have their annual meeting on December 1. The group is likely to push to extend the current level of curbs at 7.7m bpd rather than consider easing the cuts as previously planned. This would require Iraq to cut at current levels for another three months, increasing pressure on its finances.

"August was the lowest [production] month for Iraq and it's when they said that they were going to compensate for higher production since May, since the Opec deal was in place, because they struggled to cut production and exports then,” Homayoun Falakshahi, oil and gas equity analyst at intelligence provider Kpler, said.

"In August, we saw exports went bellow 3 million barrels per day and then ... back to just 3m bpd in September and in October it was 3.2m bpd. So far in November, we’ve seen relatively strong levels,” he added.

Meanwhile, the government has exhausted borrowing options domestically.

"Monetary financing from the Central Bank of Iraq increased to 28.5 trillion dinars ($23.9 billion) by end-August, from 14.1tn dinars at end-May," Fitch said in a recent note.

Borrowing has now plateaued because the government requires parliament’s approval to sanction more spending. The ratings agency expects the Iraqi state to work to secure wider external support and borrow from the IMF. But securing an IMF aid package takes time and requires a phased structural adjustment programme. Given the political divide within the country, consensus around reforms may be difficult to build.

With little room to borrow, the government may require an incentive to meet its obligations with the international producers’ alliance and also avert a financial crisis at home.

Complicating the situation for implementing critical reforms in Iraq is the allure of higher oil prices that may tempt the country to increase production. Brent, the international benchmark climbed above $45 per barrel last week following optimism about the efficacy of a vaccine trial by American pharma company Pfizer and the election of Joe Biden as the 46th US President.

Iraq, which has boosted its supplies to key demand drivers such as India and China, which together make up 70 per cent of its exports, could look to make short-term gains as prices rally.

However, implementing reforms will outweigh higher oil revenues for Iraqi policymakers, says Ali Al Saffar, energy analyst at the International Energy Agency.

"Iraq has been running a huge deficit every month this year. And $45 [oil price] will not bring them into surplus,” Mr Al Saffar said.

"So, while it's relatively better than than a few months ago, it's still hugely unsustainable for a country like Iraq. I think there is a fundamental understanding that reform needs to happen independent of the oil price,” he added.

Brent, under which two-thirds of the world’s oil is priced, was up 0.68 per cent, trading at $44.12 per barrel at 10.56am UAE time on Tuesday. West Texas Intermediate, which tracks US crude grades was up/down 0.53 per cent at $41.56 per barrel.

While higher oil prices are a strong pull for Iraq to flout its Opec+ quotas, Mr Tabaqchali says making cuts remains a challenge, particularly in enforcing pro rata across all of its fields, including Kurdistan.

"The whole world expects Iraq to be able to to comply and they look at Iraq's totality, so they look at production by the federal government, as well as by the Kurdish region. But then they expect the federal government to honour the whole obligation,” said Mr Tabaqchali.

The precarious backdrop makes the need for Baghdad to balance its books all the more compelling.

Last week, the World Bank said millions of Iraqis could be forced into poverty due to the twin shocks of the pandemic and the collapse of the oil prices. Even in its "benign scenario”, around 5.5 million Iraqis could be pushed into poverty, the Washington-based lender said.

The government’s plans to slash public wages and pensions could force an additional 400,000 to 1.7 million Iraqis into poverty unless the reforms are phased in a gradual manner.

Mr Tabaqchali estimates Iraqis total government expenditure for this fiscal year will average 96 trillion Iraqi dinars, of which 64 trillion dinars (67 per cent) will comprise salaries and pensions.

In comparison, public wages last year accounted for 47 per cent of total spending. The increase, Mr Tabaqchali says, is due to the previous Iraqi administration hiring more people in order appease protests against the government last year.

“They added more people, which meant that it increased the wage bill significantly. So, it's like an own goal,” he said.

However, Mr Tabaqchali believes a successful adoption of the proposed white paper could begin to gradually ease Iraq’s woes.

"Now the question is, does that avert financial crisis? Yes, but a qualified yes in that it still doesn't resolve the issue, because currently the current spending is way ahead of income,” he said.