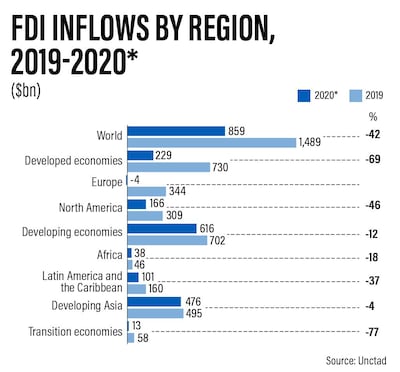

Global foreign direct investment slumped 42 per cent in 2020 and is expected to weaken further in 2021 as the Covid-19 pandemic continues to affect the pace of economic recovery, according to the United Nations.

Foreign investment flows plunged to $859 billion at the end of December, down from $1.5 trillion in 2019, the UN Conference on Trade and Development said in its latest Global Investment Trends Monitor.

Geneva-based Unctad expects FDI flows to shrink by a further 5 to 10 per cent in 2021, despite a pick-up in trade momentum and signs of an economic recovery.

“Although the global economy is expected to initiate a hesitant and uneven recovery in 2021 … investors are likely to remain cautious in committing capital to new overseas productive assets,” Unctad said in the report. “International investors tend to have a long gestation period and react to crises with a delay, both on the downward slope and in the recovery.”

Lockdowns and other mitigation measures in the wake of the Covid-19 crisis have made the implementation of ongoing projects difficult, and the impact of the global recession will linger, which mean an “FDI recovery is not expected to start before 2022”. Uncertainty related to further waves of the pandemic will also continue to affect FDI flows, according to the Unctad.

The Covid-19 pandemic, which upended global trade and disrupted the travel and tourism sector, tipped the world’s economy into the deepest recession since the 1930s. Global output is set to expand 5.2 per cent in 2021 after contracting 4.4 per cent last year, according to the International Monetary Fund’s projections.

Despite the rollout of vaccines, the number of Covid-19 infections is on the rise again, especially in Europe and North America where the second wave of the Covid-19 has forced fresh lockdowns and travel restrictions. As of Sunday, the Covid-19 infections around the world crossed more than 99 million, with 2.13 million deaths, according to Worldometer.

Unctad said the decline in FDI was largely concentrated within developed countries, where flows fell by 69 per cent to an estimated $229bn, a level not seen in 25 years. FDI to Europe also dried up completely, to a negative $4bn figure.

A sharp decrease was also recorded in the US, where flows shrunk 49 per cent to $134bn. The US, the world’s biggest economy, is the most Covid-19-affected country, accounting for a quarter of global infections.

“Inflows in developed economies were only one-third of the low point after the global financial crisis in 2009 [at $714bn],” the organisation said.

FDI to the 27-member European Union bloc fell 71 per cent to an estimated $110bn, from $373bn in 2019.

Some 17 EU countries including Germany, Italy and Austria all saw FDI decline, while the UK recorded a negative flow of $1.3bn from a positive $45bn in 2019.

Foreign investment flows to developing economies also shrunk 12 per cent to an estimated $616bn. Funding of greenfield projects was hardest hit, down 46 per cent, while funding for cross-border project finance deals fell 7 per cent. The value of cross-border mergers and acquisitions dropped by 4 per cent. Developing economies attracted a 72 per cent share of global FDI last year – the highest on record, according to Unctad.

FDI flows across developing regions was uneven, with Latin America and the Caribbean witnessing a 37 per cent fall, Africa an 18 per cent decline and Asia 4 per cent.

East Asia was the largest host region, accounting for one-third of global FDI in 2020, recording a 12 per cent increase to $283bn.

FDI in China, which witnessed steep declines in capital expenditure in the early days of the pandemic, ended the year 4 per cent higher at $163bn. FDI in India, Asia’s third-largest economy, rose 13 per cent to $57bn, boosted by investments in the country’s digital sector.

Any increase in global FDI flows this year "is more likely to come from cross-border M&A, rather than from new investment in productive assets”, the organisation said. “Announced cross-border M&A deals rebounded in the second half of 2020, mostly driven by technology and healthcare deals.”