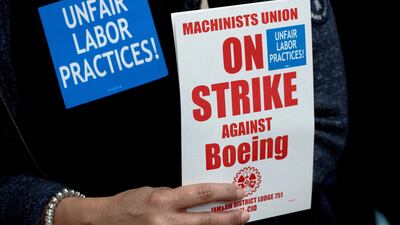

A nearly two-month-long strike by Boeing workers and two devastating hurricanes dragged down US job growth last month, although October's weak unemployment report is not expected to have a major impact on the Federal Reserve's next interest rate decision.

Total nonfarm payroll employment increased by 12,000 last month, a significant decline from September's payroll gains of 254,000 and well below FactSet's forecast of 117,500. The unemployment rate remained unchanged at 4.1 per cent.

The Bureau of Labour Statistics reported earlier this week that the Boeing strike was set to affect a total of 44,000 jobs. It was not clear how many jobs would be hit by hurricanes Helene and Milton ahead of Friday's report, but they were thought to be significant. Federal Reserve governor Christopher Waller said during a speech earlier this month that he expected Boeing strikes and the hurricanes to reduce job growth by more than 100,000.

“It is likely that payroll employment estimates in some industries were affected by the hurricanes; however, it is not possible to quantify the net effect on the over-the-month change in national employment, hours, or earnings estimates because the establishment survey is not designed to isolate effects from extreme weather events,” the department said. The bureau said strike activity led to a decline in manufacturing.

Hurricane Milton – in pictures

Friday's report comes during the Fed's blackout period, the roughly two-week window before its monetary policy meetings in which central bank officials are not permitted to speak on policy matters.

Given the volatility expected in the latest jobs report, it was not expected to heavily influence the Fed's next interest rate decision. Markets widely predict the Fed will cut interest rates by a further 25 basis points on November 7.

On Tuesday, a separate government report showed that job openings fell by 418,000 on the last day of September, adding to evidence that the labour market is moving back to pre-pandemic levels.

The US labour market has been under increasing scrutiny in recent months as Fed officials focus on protecting maximum employment now that the other side of their dual mandate – taming inflation – is considered to be won.

The Fed's preferred inflation metric – the Personal Consumption Expenditures (PCE) Price Index – rose by 0.2 per cent last month and 2.1 per cent on an annual basis. Core PCE, which excludes food and energy, rose 0.3 per cent month-on-month, its largest increase since April.

“But what’s striking – though not surprising – is how much better the trend in inflation looks: 12-month core PCE inflation is still 2.7 per cent, but the three- and six-month rates are a mere 2.3 per cent,” Kevin Burgett, senior economist at analytics firm LHMeyer, wrote to clients.