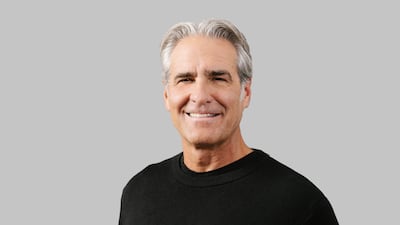

Nike has rehired its former long-time executive Elliott Hill as president and chief executive in a major shake-up as the world's biggest manufacturer of sports apparel attempts to revive its business.

Mr Hill replaces John Donahoe, who, Nike said, “decided” to retire, departing after four tumultuous years at the helm that saw the footwear and apparel company's sales stagnate and its competitors eat up market share. Mr Hill will be taking over on October 14, while Mr Donahoe will step down and remain as company adviser through January, Oregon-based Nike said on Thursday.

Having joined Nike in 1988 as a sales intern, Mr Hill rose to presidential roles overseeing commercial and marketing operations across North America and Europe for Nike and the Jordan Brand globally, before retiring in 2020.

“Given our needs for the future, the past performance of the business, and after conducting a thoughtful succession process, the board concluded it was clear Elliott’s global expertise, leadership style, and deep understanding of our industry and partners, paired with his passion for sport make him the right person to lead Nike’s next stage of growth,” Nike's executive chairman Mark Parker said.

Nike has several key sponsorships with several professional leagues and teams.

It is notably a powerhouse in the shoe sector, where its popular brands – including the Air Max, Air Force 1 and Air Jordan lines of trainers – have created its own niche in the fashion and trends scenes.

After joining the company in 2020, Mr Donahoe's remit was to boost Nike's sales channels, particularly through online and direct-to-consumer platforms. The strategy worked during the Covid-19 pandemic, when consumers snapped up more athletic clothing, helping Nike's annual sales surpass $50 billion for the first time in 2023.

However, a changing consumer landscape where customers increasingly lean towards more affordable brands have hit the company hard, allowing its competition – including its main rival adidas, industry mainstay New Balance and upstarts such as Hoka and Roger Federer-backed Swiss brand On – to catch up.

Those, along with weak sales forecasts and digital performance, have hit investor sentiment and its stock price.

Nike's shares were down about 20 per cent on Thursday, since January 2020, when Mr Donahoe took over as chief executive. It, however, rose about 9 per cent in after-hours trading, following the announcement.

Nike was also affected by weak demand in China, one of its biggest markets, where economic growth has slowed down, forcing consumers to spend less on non-essential items.

The company has also been criticised by investors and analysts for lacking innovation and variety within its products.

Nike posted flat sales in its most recent fiscal quarter, where it also warned that it would further decline by about 10 per cent in the next three-month period.

The company's workforce was also hit. In April, it was reported Nike was to cut 740 jobs at its Oregon base – the second phase of a 2 per cent headcount reduction that started in February and part of a $2 billion cost-saving plan.