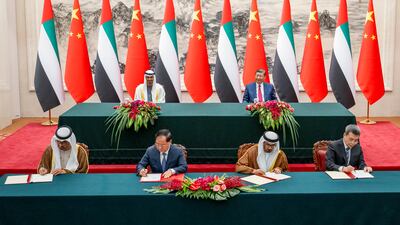

The UAE and China signed agreements to boost co-operation in investments, the Belt and Road Initiative (BRI), industry and technology, and tourism during President Sheikh Mohamed's visit to Beijing on Thursday.

The two countries also agreed to promote investment co-operation in green development, according to a report by state news agency Wam.

The announcement comes as the UAE, the Arab world’s second-largest economy, continues to bolster its ties with China, the world's second-largest economy.

The UAE is China's largest trading partner in the Arab world, with trade and investment spanning many sectors, including crude oil, petrochemicals and artificial intelligence. China is the UAE’s leading trade partner with non-oil bilateral trade worth Dh264.2 billion ($72 billion) in 2022.

Chinese investments in the UAE increased by more than 16 per cent annually last year to $1.3 billion, Zhang Yiming, China’s ambassador to the UAE, said at an Abu Dhabi event this month.

The UAE boosted its investments in China by 120 per cent last year, accounting for “90 per cent of Arab countries' investments in China”, Mr Zhang said.

The two countries are also co-operating in the Belt and Road Initiative (BRI), a mega project launched by Chinese President Xi Jinping in 2013 that aims to connect several countries in Asia, Europe and Africa through a network of infrastructure and trade-related projects.

The BRI encompasses around 65 nations and represents 30 per cent of the world's gross domestic product. The UAE is playing an important part in the initiative, with its airports and global ports for transporting large volumes of cargo to boost trade, Wam said in a report last year.

The value of the UAE's non-oil trade with countries participating in the BRI reached $305 billion in the first half of 2023, up 13 per cent compared to the same period in the previous year. This accounts for 90 per cent of the UAE's non-oil trade during that period, according to the report.

About 88 per cent of the UAE's imports also originate from countries actively involved in the BRI, while 94 per cent of the UAE's non-oil exports go towards these countries.

“The UAE's active participation and endorsement of the initiative will further fuel increased trade, infrastructure development, and transportation projects while lowering investment costs,” the report said.

The UAE has also invested $10 billion in a joint China-UAE investment fund to support BRI projects in East Africa. It is a founding member of the Asian Infrastructure Investment Bank that is playing a key part in funding BRI projects.

The UAE and China are also co-operating in the financial sector. Last year, the UAE Central Bank and the People’s Bank of China signed an agreement in Hong Kong to renew their bilateral currency swap pact for five years. The size of the agreement is Dh18 billion.

Abu Dhabi’s sovereign investment arm Mubadala Investment Company has also co-led a $300 million series B funding round for China’s industrial supply chain technology company, JD Industrials, alongside global investment manager 42XFund.

Investcorp, an alternative asset manager that counts Mubadala Investment Company as its biggest shareholder, has also teamed up with China’s sovereign wealth fund to launch a $1 billion fund that will invest in high-growth companies in Saudi Arabia, other GCC countries and China.

Some of the agreements signed by the UAE and China during the visit

• An agreement on the joint formulation of the co-operation plan on the Belt and Road Initiative

• An agreement on establishing the China-UAE High-Level Investment Co-operation Committee

• An agreement on co-operation in the field of industries and technologies

• An agreement on establishing the investment and economic co-operation working group

• An agreement on promoting investment co-operation in green development