Saudi Arabia's latest gold discovery has led to speculation it could emerge as a major regional producer of the precious metal.

The Saudi Arabian Mining Company (Ma'aden) last week announced it found massive gold deposits in the Makkah region.

The discoveries, the first from an exploration programme launched by the company in 2022, are located along a 100km strip in the south of Ma'aden's Mansourah-Massarah gold mine.

“The gold discovery could prove significant as the gold content of the ore is high,” Nasser Saidi, a former Lebanese economy minister and vice governor of the country's central bank, told The National.

Samples collected from two random drilling locations, located 400 metres below and adjacent to Mansourah-Massarah, revealed the existence of high-grade gold deposits, measuring 10.4 grams per tonne (g/t) and 20.6 g/t, respectively.

Higher-grade mines typically have densities of eight to 10 g/t, while lower-grade mines have densities of one to four g/t.

The higher the ore grade, the greater its value, and the extraction process becomes easier.

Mansourah-Massarah had gold resources of almost seven million ounces at the end of 2023 and production capacity of 250,000 ounces a year.

In comparison, Russia’s largest gold mine, Sukhoi Log, had reserves of 40 million ounces as of 2020. South Africa’s South Deep mine has about 32.8 million ounces of gold reserves.

When it comes to production, the Nevada Gold Mines complex in the US is the largest, with an annual production of about 3.3 million ounces, representing close to 3 per cent of the global gold production.

Saudi Arabia, the world’s largest oil exporter, has been looking to diversify away from crude exports by developing sectors including tourism, hospitality and finance.

Mining is also a key component of the kingdom’s drive to attract foreign direct investment as laid out in the Vision 2030 plan. It aims to more than triple the mining sector’s contribution to the nation’s economic output by the end of the decade.

“Gold mining has the potential to diversify Saudi Arabia’s economy and contribute to the kingdom’s gross domestic product,” the WGC said.

As an asset class, gold can “substantially” strengthen the kingdom’s economy, particularly the financial system, the council said.

The kingdom's economy, which expanded 8.7 per cent in 2022, the highest annual growth rate among the world's 20 biggest economies, was forecast to grow 0.8 per cent last year, according to the International Monetary Fund.

The World Bank has estimated gross domestic product growth of 4.1 per cent this year for Saudi Arabia.

For now, gold exports are unlikely to yield any significant returns, analysts say.

"The reported production capacity of 250,000 ounces a year by Mansourah-Massarah is relatively small, and if we assume that all is exported it will generate only $511 million at the current prices of gold around $2,045," said Garbis Iradian, chief economist for Mena and Central Asia at the Institute of International Finance.

"Total exports of Saudi Arabia in 2023 are estimated at $308.8 billion. Therefore, the $511 million would be a small fraction of total exports."

But the gold find may help the kingdom to reduce its reliance on imports of the precious metal.

In 2021, the kingdom imported $3.68 billion in gold, which was the fourth most imported product after refined petroleum, broadcasting equipment and vehicles, data from the World Bank's Wits platform showed.

“Central banks, pension funds and other institutional investors have long recognised the benefits of allocating to gold,” the WGC said.

“Individuals in Saudi Arabia also benefit from the financial security that gold can bring – bar and coin demand in Saudi Arabia is the largest in the GCC."

Time to shine

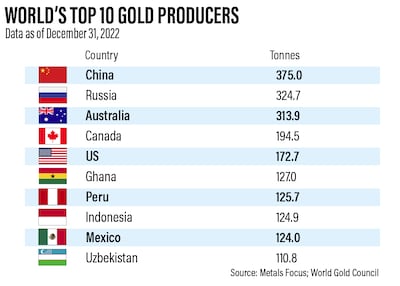

It might take some time before the discovery leads to a substantial increase in Saudi Arabia’s gold production, which experienced a 11 per cent year-over-year gain in 2022.

Usually, it takes about 10 to 20 years after the discovery of a deposit before a gold mine can yield material suitable for refining into bullion.

The country’s gold output is expected to rise 12 per cent annually between 2022 and 2026, compared with a growth of 7 per cent over the 2017-2021 period, according to GlobalData.

Although the size of the new discovery is unknown, Ma'aden said in company documents that it would undertake "aggressive escalation of planned drilling activities" this year, Reuters reported.

Ma'aden, which is 67 per cent owned by the Public Investment Fund (PIF), did not respond to The National's queries regarding future production and potential partnerships with foreign partners.

In a statement last week, the company’s chief executive said the discoveries demonstrated the untapped potential of mineral resources in Saudi Arabia.

It supports the “diversification of the country in line with Vision 2030 and establishing mining as the third pillar of the Saudi economy”, Ma'aden chief executive Robert Wilt said.

Canada’s Barrick Gold, one of the world’s largest gold producers, already has a major presence in Saudi Arabia. The company did not respond to a request for comment.

Some mining analysts said that additional gold intercepts needed to be reported in the region before an assessment could be made of the new discovery.

“All too often, amazing initial results underwhelm in further drilling or an actual resource, so we'll need to see some more intercepts reported before we get excited,” Kevin Murphy, director of metals & mining research at S&P Global Commodity Insights, told The National.

“We are withholding judgment on the potential new deposits at Massarah until more results are reported."

Vikas Lakhwani, chief revenue officer at CPT Markets in London, said it was important to approach the discovery with “cautious optimism” given the complexity of the geology.

If the resource estimates, exploration trends and infrastructure plans prove successful "this discovery has the potential to redefine the mineral landscape" of the Arabian Peninsula, Mr Lakhwani told The National.

Shining bright

Gold had a strong 2023, defying expectations amid a high interest rate environment. It hit a record high of $2,144 an ounce in early December.

Historically, gold has performed well during times of crisis and uncertainty. Its price soared during the global financial crisis, again during the eurozone crisis of 2011 and also during the Covid-19 pandemic. It hit its previous high of $2,074.20 in August 2020.

MUFG, Japan’s largest lender, expects gold to trade at $2,350 an ounce by the end of 2024, up from $2,041 currently.

“Gold is our most bullish commodities call in 2024 and is set to hit record levels on a trifecta of [US Federal Reserve] cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort,” said Ehsan Khoman, head of ESG, commodities and emerging markets research at MUFG.

“Tactically, we would view a sell-off in gold this year as a buying opportunity, as we see an environment with elevated risk channels ahead playing into gold’s favourable hedging qualities."

Mining potential

Saudi Arabia has more than 5,300 mining sites, valued at about $1.3 trillion, containing minerals including gold, silver, copper, zinc, phosphate, bauxite and limestone, a 2022 study by the Ministry of Industry and Mineral Resources showed.

The kingdom currently accounts for about 37.9 per cent of the Middle East and North Africa’s $16 billion metals and mining market, official data show. Its mining industry grew 27 per cent annually to reach more than $194 million – achieving its highest revenue in 2022.

“Saudi Arabia can attract private sector investments in underexplored regions such as the Western Arabian Shield both in precious metals, as well as critical industrial minerals that are basic resources in global decarbonisation,” Mr Saidi said.

The Western Arabian Shield region also holds valuable rare earth elements, such as tantalum, for which it has a quarter of the world's reserves. It is widely used in smartphones.

Saudi Arabia also aims to benefit from the growing demand for metals used to produce batteries – an integral component in electric cars.

In 2022, the kingdom awarded a UK-Saudi consortium the exploration licence for its largest mining site, Khnaiguiyah, about 175km south-west of Riyadh.

The Khnaiguiyah site covers more than 350 square kilometres with an estimated resource of about 25 million tonnes of zinc and copper ores, at 4.11 per cent zinc, and 0.56 per cent copper.

Overall, the kingdom's efforts to diversify the economy and attract investments through the mining sector are in the early stages and have a long way to go.

"While mining is a key component of Saudi Arabia’s drive to attract foreign direct investment in Vision 2030, FDI remained limited in the kingdom at around $8 billion in 2022 [less than 1 per cent of Saudi Arabia’s GDP]," Mr Iradian said.

"The kingdom needs to attract adequate FDI outside the energy sector to implement its plan to diversify and to create a dynamic and expanded private sector."