Global debt surged to a record $307 trillion in the first half of the year, driven by a sharp rise in borrowing among governments and financial institutions, according to a new report by the Institute of International Finance.

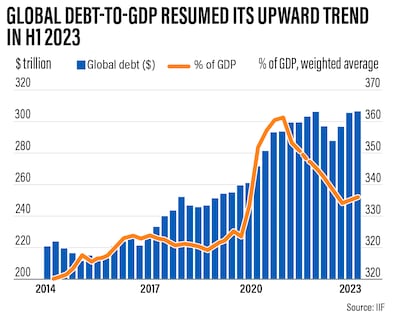

Debt rose by $10 trillion to $307 trillion in the first six months to June, which is $100 trillion more than it was a decade ago, the IIF said in its latest Global Debt Monitor report.

“More than 80 per cent of the debt build-up came from mature markets in the first half of 2023, with the US, Japan, the UK, and France registering the largest increases,” IIF economists Emre Tiftik, Khadija Mahmood and Raymond Aycock said in the report.

“In emerging markets, the rise in debt has been more pronounced in China, India and Brazil.”

The International Monetary Fund said in a report earlier this month that global debt retreated for the second consecutive year to $235 trillion last year, or $200 billion above its level in 2021.

The global debt burden remained above its “already-high pre-pandemic level”, the Washington-based lender said in a blog post.

Total debt stood at 238 per cent of global gross domestic product last year, nine percentage points higher than in 2019, the report said.

After witnessing declines in seven consecutive quarters, the global debt-to-GDP ratio resumed its upwards trajectory in the first two quarters of this year, now hovering at about 336 per cent, up from 334 per cent in the fourth quarter of 2022, according to the IIF report.

The sudden rise in inflation was the main factor behind the sharp decline in debt ratio over the past two years, allowing many sovereigns and corporates to inflate away their local currency liabilities, the Washington-based institute said.

“With wage and price pressures moderating [though not expected to return to target levels], we foresee the global debt ratio to surpass 337 per cent by the end of the year,” it added.

The rise in debt ratios this year was more evident among governments and financial institutions.

In contrast, prevailing macro headwinds, including tighter funding conditions, have led to a “marked deceleration in bank credit expansion to households and non-financial businesses”, the IIF said.

The household debt-to-GDP ratio in emerging markets remains above pre-pandemic levels, largely due to China, Korea and Thailand, according to the report.

In contrast, the household debt ratio in mature markets has dropped to its lowest level in two decades in the first six months.

“As international funding costs stabilise at higher levels, government debt in emerging markets [excluding China] has resumed its upwards trend in the second half of 2022, registering a slight increase to 57 per cent of GDP,” the research showed.

“Saudi Arabia, Poland and Turkey were the top borrowers from international markets, reflecting their substantial external borrowing needs.”

In contrast, this year has seen a sharp decline in sovereign borrowing from domestic markets, with issuance trailing 20 per cent behind last year, according to the IIF.

However, with interest expenses on local currency debt now making up more than 80 per cent of emerging market governments’ total interest costs, domestic debt levels are alarming in many countries, the IIF said.

The global financial architecture is not adequately prepared to manage risks associated with strains in domestic debt markets, the agency said.

The prolonged weakness in international capital flows into emerging markets (excluding China), which has persisted for more than a decade, remains a substantial challenge when seeking to mobilise international capital for climate action, it said.

“While the expansion of ESG debt markets has been encouraging for scaling up international capital, bridging large funding finance gaps depends on enhancing the capacity of multilateral development banks to crowd in private capital at scale, without pushing countries further into debt,” the IIF said.

“These efforts would be helped by strengthening the dialogue between countries and their investors to develop new projects, funding mechanisms, and mainstream best practices.”