The probability of the US economy slipping into recession has declined further, as encouraging inflation and job market trends bode well for the world's biggest economy, according to Goldman Sachs.

The chances of an economic contraction in the US have dropped to 15 per cent over the 12-month period, down from a previous estimate of 20 per cent, the biggest US investment bank said in its latest economic views report.

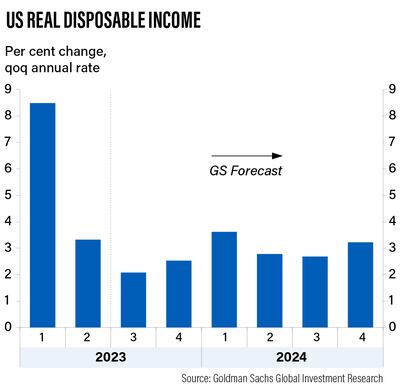

“This change reflects continued encouraging inflation news, a favourable real income outlook and the decline in the jobs-workers gap to just above its pre-pandemic level,” said Jan Hatzius, chief economist and head of research at Goldman Sachs.

Goldman Sachs has been reducing the probability of US recession since July, when it cut the chances of a contraction twice in less than a month in the wake of a milder impact of banking sector distress on the country’s economy.

The latest estimates equals an “unconditional average recession probability” calculated from the fact that a recession has occurred roughly once every seven years since the Second World War.

Goldman Sach’s estimate is far below the Bloomberg consensus, which “remains stuck at 60 per cent” and surveys from the Wall Street Journal and Blue Chip Economic Indicators.

“We are also substantially more optimistic than most other forecasters in terms of our baseline GDP [gross domestic product] growth forecast, which averages 2 per cent through to the end of 2024,” Mr Hatzius said.

Economic pressure in the US has eased in recent months, with inflation dropping towards the Federal Reserve’s 2 per cent target and encouraging trends in the job market.

An inflation metric closely monitored by the US Fed rose only slightly in August, adding to expectations that the central bank will leave interest rates unchanged in September.

The Personal Consumption Expenditures Price Index increased by 0.2 per cent, data from the Labour Department showed. Core PCE inflation, which excludes food and energy, increased by 0.2 percentage points to 4.2 per cent on an annual basis.

Headline inflation rose 3.3 per cent on an annual basis, up from 3 per cent in July.

However, Goldman Sachs said that some of the recent weakness in core CPI and, to a lesser degree, core PCE inflation “reflects residual seasonality”.

“Underlying inflation may already be near the Fed’s target, despite the ups and downs of commodity prices, traditional ex-food and energy inflation, and the core services ex-housing CPI or PCE measures,” Mr Hatzius said.

US employers added 187,000 jobs in August, more than expected, but underlying numbers remained positive.

“Despite this strength, rebalancing in the labour market is well advanced as both our jobs-workers gap and the ‘quits rate’ have essentially returned to their pre-pandemic levels,” Mr Hatzius said.

“It is also encouraging that average hourly earnings rose just 0.2 per cent in August, although a further decline in our wage tracker from the current year-on-year rate of 4.4 per cent to around 3.5 per cent is probably needed to make Fed officials fully comfortable.”

The Fed has raised interest rates 11 times since March 2022 to bring inflation down to its target range.

However, Goldman Sachs said its confidence that the Fed is finished with raising interest rates has grown in the past month.

“We view chairman Powell’s promise at Jackson Hole to ‘proceed carefully’ as a signal that a September hike is off the table and the hurdle for a November hike is significant,” Mr Hatzius said.

Fed officials, however, are unlikely to move quickly towards an easier monetary policy unless growth slows more than forecasts in the coming quarters.

“We, therefore, expect only very gradual cuts of 25 basis points per quarter starting in the second quarter of 2024,” Mr Hatzius added.