Alkhair Capital, an asset management and investment banking company, has launched a $100 million fund to invest in healthcare technology ventures as it looks to boost the portfolio of its investments.

The Dubai International Financial Centre-domiciled Sharia-compliant investment fund will target companies that are “harnessing cutting-edge artificial intelligence to bolster healthcare providers”, it said in a statement on Monday.

Designed as an open-ended fund, the investment vehicle aims to provide liquidity to target companies to boost their growth.

“The healthcare sector is experiencing remarkable growth, propelled by the region's expanding senior citizen population, rising life expectancy and a surge in lifestyle diseases,” Naveed Aurakzai, chief executive of Alkhair Capital Dubai, said.

“This surge has led to significant challenges, including insufficient infrastructure, higher medical claim settlements and liquidity constraints due to extended working capital cycles.”

The new investment vehicle will play “a pivotal role in addressing liquidity challenges that are “hampering the profitability and expansion of medical facilities”, he added.

The UAE health sector currently has $1.2 billion in medical claims caught in processing and healthcare facilities encounter a delay of 112 days on average to receive 90 per cent of their payments from insurance companies, Mr Aurakzai said, citing Alkair’s internal data.

“We launched this investment fund with the primary aim of addressing one of the most formidable challenges within the sector, estimated to encompass $100 billion in spending within the GCC,” Mr Aurakzai said.

The healthcare sector in the GCC and the wider Mena region has seen significant growth and transformation in recent years, driven by the Covid-19 pandemic and the subsequent investments poured into the industry by stakeholders.

Reforms by regional governments, particularly in the six-member economic bloc of GCC, such as the mandatory health insurance have played a vital part in the growth of the sector.

The current expenditure in the GCC is projected to reach $135.5 billion in 2027, growing at an annual growth rate of 5.4 per cent from 2022, Dubai-based Alpen said in a report earlier this year.

Healthcare expenditure as a proportion of gross domestic product in the region is expected to grow from 5 per cent in 2022 to 5.8 per cent in 2027, the report added.

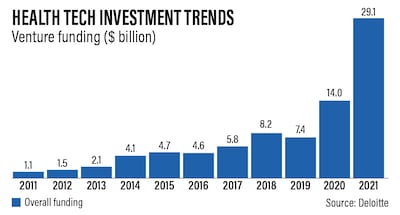

Global funding for health tech companies in 2021 amounted to $29.1 billion across 729 deals, with an average deal size of $39.9 million, according to the consultancy Deloitte. The market is expected to continue growing in the next few years with R&D attracting investment, followed by on-demand health care and treatment of disease.

Alkhair Capital has partnered with Klaim Technologies, a FinTech that provides AI-powered solutions for assessing insurance claims, as part of its proactive investment management approach to meet the objectives of the new fund.

Alkhair will allocate the underlying investments across short to medium-term durations as it aims to strike a balance between fulfilling the liquidity requirements and achieving favourable returns.

“Our partnership with Alkhair ... marks a significant step towards resolving the pressing liquidity challenges in the healthcare sector,” Karim Dakki, chief executive of Klaim, said.

"Leveraging our AI-driven insurance claims assessment technology, we aim to optimise and accelerate the claims process, facilitating prompt payments to medical facilities."

Alkhair, which provides asset management and investment banking services including debt and equity capital market transactions, as well as, mergers and acquisition deals advisory, launched operations in Saudi Arabia in 2009.

The company opened its DIFC office in the 2014 and also offers custody services to its clients for stock markets in Saudi Arabia and the UAE, according to its website.

It manages several funds including Alkhair Capital Sukuk Plus Fund, Alkhair Murabaha Fund, Saudi Equity Fund and Alkhair Capital IPOs Fund.