Morgan Stanley is said to be preparing a fresh round of job cuts amid a renewed focus on expenses as recession fears delay a rebound in deal making.

Senior managers are discussing plans to eliminate about 3,000 jobs from the global workforce by the end of this quarter, according to people with knowledge of the matter.

That would amount to about 5 per cent of staff excluding financial advisers and personnel supporting them within the wealth management division.

The banking and trading group is expected to shoulder many of the reductions, one of the sources said. A representative for New York-based Morgan Stanley, which employs about 82,000 people, declined to comment.

The firm trimmed about 2 per cent of its workforce only months ago.

Wall Street’s biggest banks offered few reasons for cheer while reporting first-quarter results after seeing their fees from helping companies with takeovers and raising capital — a proxy for the economy’s health — slump over the past year.

The Federal Reserve’s desire to curb inflation through rate hikes and the ensuing regional-banking tumult have further dampened activity.

Chief executive James Gorman last month said underwriting and merger activity had been subdued and a rebound before the second half of this year or in 2024 was not expected.

In the first quarter, Morgan Stanley’s profit fell from a year earlier, dragged down by a drop-off in deal making, with a 32 per cent decline in its merger advisory and 22 per cent slump in its equity-underwriting business.

Analysts are forecasting that revenue from banking fees will be in line with last year’s haul — which was about half the $10.3 billion the bank pulled in during 2021’s deal-making frenzy.

Revenue within the bank’s institutional securities group, which houses the bankers and traders, slid 11 per cent in the quarter ending March. Its wealth-management unit went the other way, climbing 11 per cent compared with a year ago.

The companywide results also saw Morgan Stanley’s efficiency ratio — a measure of non-interest expense relative to revenue — hit 72 per cent. The bank has spelt out a target of keeping that figure below the 70 per cent mark.

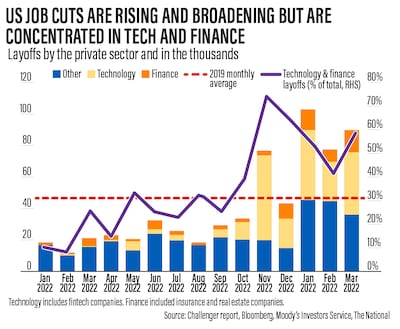

Industry cuts

Job cuts across finance have returned since the pandemic, when banks held off on reductions to give employees stability and then fought for talent as deals picked up. But as that frenzy cooled, expenses have become the focus with several banks unveiling plans to fire staff.

Morgan Stanley in December cut roughly 1,600 jobs. Then Goldman Sachs eliminated about 3,200 positions in January in one of its biggest cuts ever.

On Monday, Citigroup chief executive Jane Fraser said her company was willing to make adjustments to staffing levels at its investment bank.

“Like every institution, you make some adjustments around the capacity but we’re playing the long game in investment banking,” Ms Fraser said in a Bloomberg Television interview.

Ken Jacobs, who runs Lazard, forecast that industry doldrums will last for the rest of the year.

Lazard will eliminate 10 per cent of its workforce, the New York-based firm said last week. Mr Jacobs noted that dealmaker pay has surged in recent years as junior bankers demanded higher salaries amid a boom.

It is harder to roll back those raises, while costs for travel, entertainment and information services have soared as well, he said in an interview last week.