Bilateral trade between the six-member economic bloc of GCC and Asia is set to reach $578 billion by the end of this decade as Gulf economies increasingly pivot to one of the fastest-growing regions in the world.

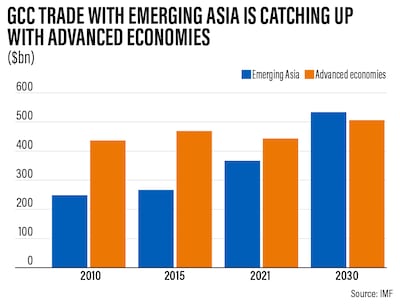

Two-way trade between the GCC and Asian markets will expand 6 per cent on average annually, surpassing the Gulf bloc’s trade value with advanced economies by 2028, UK-based think tank Asia House said in its latest research on Wednesday.

Emerging Asia will account for about 36.41 per cent of GCC's total trade in the region by 2030, up from the current 30.83 per cent, according to the report released at an event organised by Abu Dhabi-based private equity company Gulf Capital.

“Rapidly expanding ties between the Gulf and Asia are creating a fundamental global shift that will have far-ranging implications for international trade, business and politics,” said Freddie Neve, senior Middle East associate at Asia House, who wrote the Middle East Pivot To Asia 2022 report.

The investment corridor is growing in both directions and across various industries, including oil and non-oil sectors.

“In particular, Gulf economic diversification, which is moving at a staggering pace, is attracting Asian investment into emerging economic sectors within the GCC, such as construction, renewables and technology,” Mr Neve said.

“We also expect sustainability co-operation to grow in importance as Gulf and Asian economies transition away from hydrocarbons over the next few decades.”

Gulf economies are increasingly pivoting to the fast-growing Asian markets. Asia’s rate of growth is set to surpass the rest of the world this year as the outlook of the regional economies improves, despite mounting geopolitical risk and global macroeconomic headwinds, according to the International Monetary Fund.

Growth in Asia increased to 4.7 per cent this year, up from last year's 3.8 per cent, which will make it “by far the most dynamic of the world’s major regions and a bright spot in a slowing global economy”, senior IMF officials wrote in a blog post this week.

The emerging and developing economies in Asia that are expected to expand by 5.3 per cent this year are also driving the economic “dynamism” of the region.

China and India alone are expected to contribute more than half of global growth this year, with the rest of Asia contributing an additional quarter.

Cambodia, Indonesia, Malaysia, the Philippines, Thailand and Vietnam are all back to their robust pre-pandemic growth, the IMF officials said.

The oil-rich economies in the GCC are keen to strengthen trading ties with their partners in Asia.

The UAE, the second-largest Arab economy, has already signed a comprehensive economic partnership agreement with India, Asia’s third-largest economy, and Indonesia. It is negotiating similar deals with several other Asian nations.

Trade between the UAE and India has increased by 10 per cent in the year since the countries signed the treaty, setting the stage for greater co-operation with other Asian economies.

Gulf Capital, which focuses on investments in South-east Asia, had identified this trend early on, and during the past 15 year, “we’ve been looking East when growing [our portfolio] companies from the GCC”, said Karim El Solh, co-founder and chief executive of Gulf Capital.

“Taking our local companies through this corridor has helped us build global champions, which have become trophies for strategic buyers looking at acquiring cross-country platforms to boost their businesses,” he added.

The interest of the GCC’s sovereign wealth funds (SWFs) in Asian investments will also “continue to grow and will be a key trend defining the Middle East pivot to Asia over the next decade”, according to the report.

Gulf SWFs have estimated assets worth more than $2.5 trillion and changes to their investment strategies can have a considerable effect on global finance.

The state funds are looking for ways to increase their exposure to Asian markets.

As of July, they were involved in $28.6 billion worth of acquisitions outside the Middle East and Africa, 45 per cent more than in 2021, with investments heading towards China, India and Singapore, the report said.

“Despite global economic uncertainties, the Middle East pivot to Asia has exceeded expectations in the last year and is likely to accelerate over the next decade, heralding a profound shift in global trade and cross-border investments that will impact growth, business and geopolitics,” Mr Neve said.