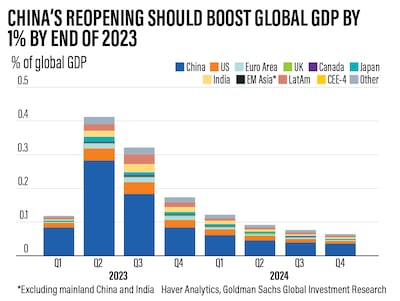

The reopening of China’s economy and a full recovery in the country's domestic demand may raise global output by around one per cent in 2023 and lead to a rally in oil prices, according to a report by Goldman Sachs.

Regional Asian economies and oil exporters are likely to be the biggest winners from China’s reopening, but it also should provide a healthy boost to gross domestic product levels in most economies, the global investment banking and securities firm said.

China’s reopening should "provide a boost to commodities demand and prices, particularly for oil”, Joseph Briggs and Devesh Kodnani, the authors of the report, said.

“A recovery to trend should boost Brent oil prices by roughly $15 per barrel. In a more aggressive reopening scenario in which international travel recovers more rapidly, prices could rise further, for a cumulative increase in oil prices of up to $21 per barrel, or more than 20 per cent of the current level.”

China, the world’s second-biggest economy, is forecast to expand 5.2 per cent this year after beating expectations with a 3 per cent acceleration in 2022, according to the International Monetary Fund. Growth rebounded to 8.4 per cent in 2021 following a deceleration after the Covid-19 pandemic in 2020.

India and China will account for half of global growth this year, compared with only a tenth for the US and euro area combined, according to the IMF, which raised its global economic growth estimate for this year by 0.2 percentage points to 2.9 per cent in its World Economic Outlook report.

China’s growth outlook faces "significant risks", stemming from the uncertain trajectory of the Covid-19 pandemic, how policies evolve in response to the Covid-19 situation and the responses of households and businesses, the World Bank said in a December report.

Additionally, "persistent stress" in the real estate sector could have wider macroeconomic and financial spillovers, while risks related to climate change are growing, the Washington-based lender said.

External risks to China's growth outlook include highly uncertain global growth prospects, greater-than-expected tightening in financial conditions and heightened geopolitical tensions, according to the World Bank report.

Goldman Sachs said that oil price increases caused by the reopening of China’s economy will add 0.1 per cent to 0.3 per cent to Canada and Latin America GDP levels, but lead to declines of 0.1 per cent to 0.6 per cent from the output in other economies.

“For most economies, higher oil prices will weigh on real incomes and growth, thereby offsetting the boost from the recovery in goods and services trade. However, net oil exporters such as Canada and some Latin American economies should benefit from higher prices and demand,” the New York-based company said.

Increased domestic demand in China — to the tune of a 5 per cent increase — should boost goods exports from other economies, although this growth boost should prove modest outside of Asia-Pacific economies, according to the report.

Reopening-led goods demand will provide a moderate boost of 0.3 per cent to 0.4 per cent to GDP in most Asia-Pacific economies and roughly half that in Latin America, but relatively small positive effects elsewhere, it added.

Meanwhile, a recovery in Chinese demand for foreign services — particularly for international travel — should also provide a modest boost to global growth, Goldman Sachs said.

A full normalisation of international travel will provide a sizeable GDP boost to Asian emerging markets and other regional economies but a more modest boost elsewhere, although there could be somewhat larger effects if there is significant pent-up demand for international travel from China, according to the report.

China’s reopening is also expected to boost global inflation.

Reopening-led oil price increases will contribute 0.5 to 0.6 percentage points to headline inflation in most emerging markets and roughly half that in the US, though effects could be roughly 40 per cent larger in the event of a faster reopening pace, Goldman Sachs estimated.

“The clear risk from reopening is that stronger growth could lead inflation to surprise to the upside later this year,” the report said.

“As a string of mostly downside inflation surprises have driven an easing in global financial conditions and enabled central banks to slow the pace of rate hikes in recent months, a larger inflation impulse from reopening may force central banks to hike rates further than markets currently expect to keep growth below potential and remain on track to tame inflation.”

After hitting 8.8 per cent in 2022, global inflation is expected to fall to 6.6 per cent in 2023 and 4.3 per cent in 2024, still above pre-pandemic levels of about 3.5 per cent, the IMF said last month. About 84 per cent of countries are expected to have lower headline inflation in 2023 than in 2022.