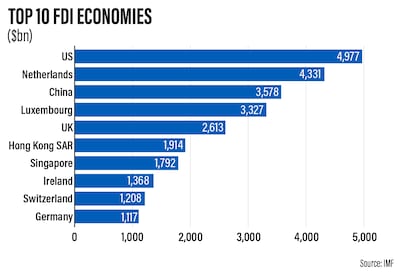

The US was the top recipient of foreign direct investment last year, attracting 11.3 per cent more in inflows than in 2020, according to the International Monetary Fund.

The world's largest economy attracted $506 billion more in 2021 than in the previous year, boosting the total amount of FDI in the country to about $5 trillion, the Washington-lender said in a report on Wednesday.

This was the largest increase on a list of 112 economies that reported data in 2021.

For all of the economies, inward FDI positions rose by an average of 7.1 per cent in national currencies, but in dollar terms, this global growth is equivalent to 2.3 per cent, due to the recent strengthening of the greenback.

The Netherlands came in second, attracting $4.33 trillion, while China, the world's second-largest economy, moved up to the third position with about $3.6 trillion of inflows.

Luxembourg, the EU's second-smallest state, had $3.3 trillion of FDI.

The UK, which has had its most tumultuous year politically, with its economy slipping a notch behind India to become the sixth largest globally, attracted $2.6 trillion.

Asia's competing financial centres were not too far apart, with Hong Kong receiving slightly more than $1.9 trillion while its rival Singapore had about $1.8 trillion of inflows.

Ireland, one of the richest countries in western Europe and arguably has the highest gross domestic product per head among its peers, attracted about $1.4 trillion.

Switzerland, which has one of the highest per capita GDP globally and has an economy led by the financial services and manufacturing industries, attracted over $1.2 trillion.

Germany, Europe's largest economy and industrial engine, had about $1.1 trillion of FDI inflows.

“The apparent disconnect between FDI data and the real economy comes down to the fact that these numbers are fundamentally a set of financial statistics,” wrote Jannick Damgaard and Carlos Sanchez-Munoz of the IMF's statistics department.

“They show cross-border financial flows and positions between entities tied to each other by a direct or indirect ownership share of at least 10 per cent.

“Such flows can end up as investments into productive activities within a country, like funds going into new factories and machinery, but they can also be purely financial investments with little to no link to the real economy.”

Offshore financial centres still account for a disproportionately high share of global FDI, but their share has gradually declined since 2017, while that of the largest economies such as the US and China has increased, the authors said, citing data from the IMF’s Co-ordinated Direct Investment Survey.