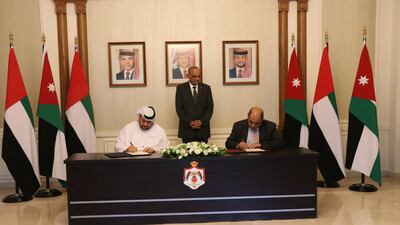

Abu Dhabi's holding company ADQ has launched a $100 million technology-focused venture capital fund in collaboration with the Jordanian Ministry of Digital Economy and Entrepreneurship.

The fund will support Jordan’s digital economy by investing in high-growth companies with proven business models along with other funds primarily focused on the country, the entities said in a joint statement on Wednesday.

The fund has been established in recognition of the “strong potential of Jordan’s tech ecosystem”, said Mohamed Alsuwaidi, managing director and chief executive of ADQ.

About 27 per cent of tech entrepreneurs in the Middle East and North Africa are Jordanian and the country is home to more than 600 technology companies, the statement said.

“Jordan’s dynamic marketplace offers vast investment potential in sectors where we have significant expertise,” Mr Alsuwaidi said.

“By unlocking access to our growing portfolio of leading companies, we intend to accelerate growth opportunities and market access for companies, entrepreneurs and funds that are at the cutting-edge of technology.”

The UAE and Jordan are boosting economic co-operation and late last month, the two countries, along with Egypt, entered into an industrial partnership aimed at enhancing sustainable growth and exploring opportunities for joint investments in priority sectors.

As part of the deal, a $10 billion investment fund has been set up and will be managed by ADQ to accelerate work on the partnership across five priority sectors including petrochemicals; metals, minerals and downstream products; textiles; pharmaceuticals; and agriculture, food and fertilisers.

The new VC fund in Jordan will be dedicated to tech start-ups and innovation-led companies specialising in various sectors such as information technology, telecoms, financial services, education, food and agriculture, health care and life sciences, mobility and logistics and clean energy technologies, the joint statement said.

The announcement marks a “significant milestone in Jordan’s economic growth and reflects our focus on partnering with world leading organisations to deliver positive impact and change”, said Ahmad Al Hanandeh, Jordan’s Minister of Digital Economy and Entrepreneurship.

“Designed to accelerate the transformation of the digital economy, ADQ will invest, alongside [the ministry], in high-growth technology companies that will help to create, promote, and drive new digital opportunities in Jordan, and reinforce our place on the world technology map.”

The fund “complements ADQ’s strategy to unlock mutually beneficial growth opportunities and deliver sustainable financial returns to the UAE and its partners”, the statement added.

Established in 2018, ADQ is an Abu Dhabi-based investment and holding company. Its investments span key sectors, including energy and utilities, food and agriculture, health care and life sciences, and transport and logistics, among others.