Amazon founder Jeff Bezos' trip to India two years ago and his announcement of $5 billion in investment there over the next five years was met with a lukewarm reception from New Delhi.

Though it was a shot in the arm for Indian policymakers' efforts to shore up foreign direct investment, there weren't many statements to hail Mr Bezos' announcement as a victory.

While those advocating an open market economy celebrated Mr Bezos' visit, not everyone was happy with his arrival.

Local traders protested holding up banners with slogans including, “Amazon Go Back!”. Just hours before his arrival, the country's antitrust regulator opened a formal investigation into Amazon's business practices and those of its home-grown rival Flipkart, majority-owned by Walmart.

That somewhat strained visit is a reflection of the challenges that Amazon continues to face in India – including legal wrangles, changing regulations and battles with Indian companies for market dominance. But Asia's third-largest economy is a critical market for the US company's global growth agenda and it is willing to fight to overcome these hurdles.

“It's a well-established fact that the Indian e-commerce sector has great potential for growth and that India is too big a market for global players to ignore,” says Yashojit Mitra, a partner at law firm Economic Laws Practice.

“Therefore, even with legal or regulatory hurdles, there will be a willingness from Amazon to continue in India with tweaks to their operating structures – if required,” Mr Mitra, who oversees the firm's corporate commercial practice, says.

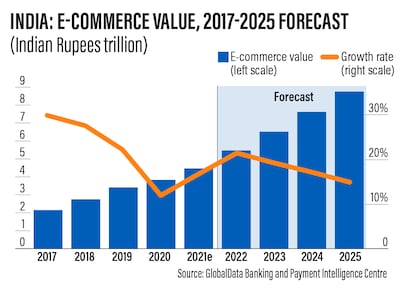

E-commerce sales in India are expected to increase at a compound annual growth rate of 18.2 per cent between 2021 and 2025, to reach 8.8 trillion Indian rupees ($117.3bn) in 2025, according to a GlobalData forecast.

Rapidly rising smartphone ownership and internet use among India's almost 1.4 billion people, along with the government's push to digitalisation, has fuelled the sector’s growth in recent years, GlobalData research shows.

With the country's middle class expected to expand over the coming years, the consumer base is only going to get stronger. The shift from in-person shopping to online purchases during the pandemic will also continue to boost e-commerce sales in the years to come.

In December, Amazon said that more than a million sellers were now part of its platform in India, after starting out in 2013 with only 100.

“An exciting time lies ahead for e-commerce and payment companies in India,” says Ravi Sharma, banking and payments lead analyst at GlobalData.

While the market potential is huge, it is far from easy to navigate. Amazon's legal troubles have only grown since Mr Bezos' visit in January 2020.

Under Prime Minister Narendra Modi's government, New Delhi has been trying to reduce the country's dependence on imports and promote domestic businesses. Mr Modi launched a campaign called “Atmanirbhar Bharat”, as the pandemic battered the country in 2020. It is Mr Modi's vision of creating a “self-reliant” India.

This policy shift “has given impetus to smaller vendors to come together to challenge the supremacy of corporate giants”, Mr Mitra says.

“There were also trickle-down effects as the EU has filed anti-trust charges against Amazon for unfair practices,” he adds.

The tens of millions of traders and shopkeepers across the country are critical voters of Mr Modi, and helped him to stay in power in a landslide victory in the 2019 national elections.

They have long argued that Amazon's rise will push them out of business, putting livelihoods at risk, so keeping them happy is vital for the longevity of Mr Modi's political career.

Industry body the Confederation of All India Traders, which represents some 80 million traders, has filed several complaints to the government and regulators, claiming that the US giant and Flipkart are flouting regulations. These include accusations that the e-commerce companies are engaging in predatory pricing and not competing on a level playing field. Amazon and Flipkart have denied allegations of unfair practices.

In a statement released on Monday, CAIT described Amazon as having “sinister designs ... to capture the physical retail trade and inventory-based e-commerce in India causing enormous harm to the traders”.

But Amazon has forged partnerships with local businesses and argues that it is generating jobs and supporting the economy.

Last year, it announced a $250 million venture fund to help bring small businesses in India online.

The company says that more than 90 per cent of the sellers on its platform in India are small- and medium-sized local businesses. Amazon has also outlined plans to bring one million offline stores in India on to its platform by 2025.

“It is heartening to see the role Amazon is playing in enabling small local businesses across the country, including local offline retailers and neighbourhood stores from across India that are adopting e-commerce,” Manish Tiwary, vice president, Amazon India, said in a press release last month.

“We strongly believe that Amazon can play a significant role in fuelling India’s digital economy to its $1tn ambition.”

Analysts say Amazon has identified India as a “strategic market” and will go through hoops to grow its business in the country.

Richa Agarwal, a senior research analyst at Equitymaster, says that it is not just the e-commerce sector that Amazon is targeting, it is interested in education technology and food sectors that also offer growth potential.

Amazon launched an internet pharmacy service in the city of Bengaluru in 2020, and this month Amazon Prime Video debuted its live cricket streaming service in India. It also has a presence in the online payments sector with Amazon Pay.

“But things are not going to be easy in the Indian market,” says Ms Agarwal.

One major factor is fierce competition.

Amazon is competing with market leader Flipkart, which was founded by two former Amazon employees, before a controlling stake was sold to Walmart in 2018 for $16bn. In the digital payments space, its rivals include SoftBank-backed Paytm and Flipkart-backed PhonePe.

Changing regulatory landscape in India is another factor that may hamper Amazon's expansion plan.

“There could be regulatory developments in the sector that could favour local competition over outsiders,” adds Ms Agarwal.

Amazon suffered a setback in 2018 when India changed its investment regulations and prevented foreign e-commerce companies from listing products from sellers in which they hold an equity stake.

That forced Amazon and Walmart-owned Flipkart to adjust their business structures and caused a rift between New Delhi and Washington, with the latter accusing the policy change of favouring local companies.

partner at law firm Economic Laws Practice

Even before that, Amazon's business had been held back in India by the fact that it is only allowed to operate as a marketplace rather than a retailer which sells its own products, due to Indian regulations for foreign e-commerce companies.

“Long-standing laws in India have constrained Amazon, which has yet to turn a profit in the country,” says Ashutosh Paarcha, an advocate who practises at the Indian Supreme Court.

He believes that ultimately there would have to be some “give-and-take” from both the authorities and Amazon.

“The government wants to portray India as a prospective land for business and would try to work something around for the ease of doing business,” Mr Paarcha says.

“Similarly, Amazon will make certain changes going forward to enhance and expand its business in India.”

However, the issues that Amazon is facing in India do impact global investors' and companies' perception of the country as an investment destination, Mr Mitra says.

“It cannot be disputed that legislative changes do bring uncertainty in the business operations of global investors and companies,” he adds.

Amazon's biggest challenges to date in India, however, is not a feud with regulators, but a tiff with the corporate India. For more than a year it has been locked in a legal battle with Future Group over the Indian company's decision to sell its retail assets to Reliance Retail, which is part of the sprawling conglomerate Reliance Industries that is controlled by Indian billionaire Mukesh Ambani.

Amazon in 2019 bought a 49 per cent stake in Future Coupons. It is challenging the proposed Reliance-Future $3.4bn deal – which was announced in August 2020 – on the grounds that the conditions of its own agreement with Future prevents the transaction from taking place.

The case is going through the courts and has now reached India's Supreme Court. At stake is greater access to India's multibillion retail market. If Reliance is allowed to go ahead with the deal, this would give it a significant advantage over Amazon.

But experts say that even that challenge is not insurmountable for Amazon to keep growing in India.

With its deep pockets, the company has the ability to keep ploughing in funds to fuel its expansion.

“The company has been burning cash in numerous lawsuits,” says Mr Paarcha, adding that despite this, “given the magnitude of the Amazon corporation, it is highly probable that they will continue to grow in India”.

“A lot of people have started relying on Amazon” for products to serve their daily needs, he says.

However, Ms Agarwal says that things may get tough before they get better for Amazon in India.

“While India is a high potential market, with the ongoing dispute over Future Group’s retail assets and emerging regulations in a highly competitive market with behemoths like Reliance, Flipkart [and] Tata, Amazon’s commitment to India will be tested,” she says.