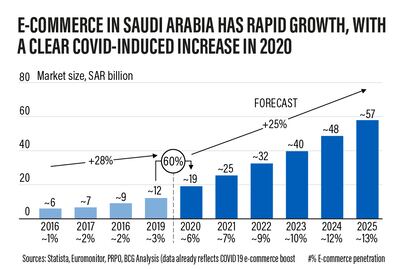

Saudi Arabia's e-commerce market, which grew about 60 per cent in 2019-2020 amid a digital uptick that accelerated during the pandemic, is poised to hit $13.3 billion by 2025, according to a study from Boston Consulting Group and Meta Platforms.

Online sales grew steadily from 2016 – 2019 driven predominantly by apparel, electronics, and appliances, with sales increasing by more than 30 per cent on average annually, across all categories.

"From an economic standpoint, increased retail spending nationwide is primed to be among the most prominent, a trend that is a near-certainty due to more products becoming accessible to large audiences and foreign retail expenditure being captured. Together, these factors will yield several positive outcomes, all of which will come to fruition in due course," Pablo Martinez, managing director and senior partner at BCG, said in the report.

The Covid-19 pandemic has increased e-commerce adoption, as more consumers shop online.

About 77 per cent of consumers in Saudi Arabia are shopping online more frequently now than they were before the pandemic, according to a survey by Mastercard. The percentage of online shoppers in the kingdom outstripped the average for the Middle East and Africa region of 73 per cent, Mastercard said in its recent e-commerce survey.

Despite its fast expansion, the segment is still in a nascent stage. Saudi online sales accounted for just 8 per cent of total retail sales in the kingdom, compared to the global average of 18 per cent and the 30 per cent to 40 per cent posted by the world's leading e-commerce markets, the report said.

But the "tremendous" potential is already apparent despite its infancy, and the advancement of a robust e-commerce ecosystem in the years ahead will present many economic and social benefits.

Consultancy AT Kearney estimated that GCC e-commerce revenues surged almost fivefold from $5bn in 2015 to $24bn last year, predicting that this will thrive further thanks to a permanent change in consumers' behaviours.

Despite that, Saudi Arabia and the wider Middle East and North Africa region still lag in e-commerce market share, with penetration levels of only 5.9 per cent and 2.7 per cent, respectively, in 2020 – far behind mature markets and the worldwide average of 18 per cent.

However. the region has the fundamentals to grow the e-commerce, with Saudi Arabia especially well positioned to become the regional powerhouse, BCG said.

Taking advantage of social commerce – using platforms such as social media and messaging platforms to reach more consumers – helps retailers gain a competitive advantage. This, in turn, has made convenience the top priority for Saudi Arabian consumers, with 90 per cent looking for ways to simplify their experience and save time.

“The kingdom is now more connected to the rest of the world than ever before and Saudi consumers are also demanding a new kind of relationship with brands. We are seeing users in the kingdom engage with each other in creative ways,” said Suha Haddad, director of agencies and ecosystem development for Mena at Meta Platforms.

Saudi Arabia's retailers recognise that establishing a strong, local e-commerce presence with in-country product stock, efficient last-mile logistics, cheaper and faster delivery, and product returns could help them quickly grab market share from global operators, the study said.

But despite the growth, e-commerce players in Saudi Arabia and the GCC still face challenges, with the limited size of product assortment one of them. Regional e-commerce player Noon.com has stock-keeping units – numbers assigned to products to keep track of stock levels – of more than 5 million, while apparel leader Namshi has around 100,000. However, these pale in comparison to the likes of Amazon's 350 million in the US and Rakuten's 250 million in Japan.

Regional GCC e-commerce operators are also limited when it comes to delivery speed and options. Within Saudi Arabia, only a small set of online retailers in major cities offers same-day delivery, which is a standard in advanced markets elsewhere in the world.

managing director and senior partner at BCG

There are also tangible economic benefits, including job creation and opportunities for entrepreneurship. The growth of the Saudi e-commerce industry will generate a significant number of jobs requiring varied qualification levels, including skilled positions in management and technical work functions. E-commerce can also enable entrepreneurship through the provision of efficient market access to new consumer products.

"To achieve success in this direction, a sustainable business environment is essential, as are key enablers that will drastically improve the e-commerce business environment, namely last-mile logistics, cross-border training, e-payment adoption, incubators and internet," said Chris Biggs, managing director and senior partner, and global leader of BCG’s retail sector.

Earlier this year, accounting and consulting company Deloitte set up a programme to improve the digital skills of young Saudis and help them learn about the latest trends in e-commerce as part of the kingdom's push to develop its non-oil sector and create jobs for citizens.