An open and stable global trading policy is critical for the green transition while a lack of policy stability will increase the cost and reduce the pace of investment in decarbonisation, according to the World Economic Forum.

Businesses are actively pursuing and ready to accelerate their emission reduction programmes, however, the global trading system needs to adapt to help companies reach their eventual net-zero goal, the WEF said in a climate and trade white paper released on Monday.

“Traditionally, trade and climate policy-making has happened in separate silos. [However,] the urgency of the climate crisis calls for us to break down these silos through public-private co-operation in order to accelerate emissions reductions while achieving prosperity for all,” said Sean Doherty, head of International Trade and Investment and a member of the WEF Executive Committee.

“The good news for policymakers is [that] businesses are ready and willing to support this change.”

The six-month study, jointly carried out by the WEF and global law firm Clifford Chance, is based on research and interviews with global companies across various industries that include transport, energy, manufacturing and consumer goods.

The Covid-19 pandemic has brought 'Build-Back-Better' plans and greener economies into sharp focus, underpinning the need to invest in meeting the UN climate goals and transitioning to a net-zero economy.

The 2015 Paris Agreement mandates countries to lower their carbon emissions to meet the goal of limiting the temperature rise to 1.5°C. Energy producing nations are already investing in technologies such as green hydrogen and renewable power to meet their climate agendas.

In August, former Bank of England governor Mark Carney asked governments around the world to unite in making climate-related financial disclosures mandatory and set up a global body to establish unified sustainability reporting standards for the global corporate sector.

The number of global corporations with a combined market value of more than $25 trillion from 86 nations are currently supporting the Task Force on Climate-related Financial Disclosures (TCFD) reporting. The number has more than doubled from 1,000 in the first quarter of 2020 until July this year, he said at the time.

The volume of world merchandise trade, which slumped 5.3 per cent in 2020, has rebounded from the pandemic-induced collapse that bottomed out in the second quarter of last year. It is expected to grow 8 per cent in 2021, according to World Trade Organisation estimates.

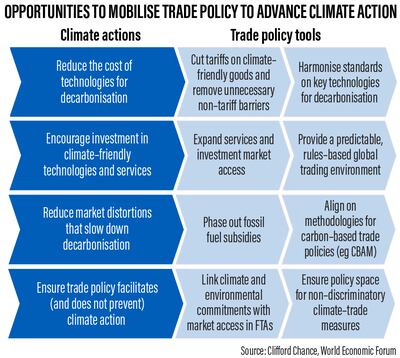

The WEF said the objective of its research is to identify necessary changes to the current global trade system and how to better incentivise and accelerate decarbonisation. Businesses surveyed highlighted steps including tariff reductions on goods that are key for decarbonisation and addressed non-tariff distortions as vital for an open global trade environment.

Phasing out fossil fuel subsidies and building “coherence around carbon-based trade policies”, are also central planks of a stable trade policy that will encourage decarbonisation, according to the WEF report.

Member, WEF Executive Committee

The International Monetary Fund has also called for levying taxes on carbon and in April, its managing director Kristalina Georgieva said a policy mix of carbon taxes and green investment stimulus, could increase the level of global output in the next 15 years by about 0.7 per cent and create around 12 million new jobs through 2027.

Other steps to encourage sustainable trade growth include supporting trade in digital and climate-related services, encouraging climate-smart agriculture, aligning trade agreements with climate commitments and facilitating green investments, the WEF said.

“International trade will play a key role in achieving a just transition to a low-carbon sustainable global economy,” Jessica Gladstone, partner at Clifford Chance, said. “Businesses stand ready to lead in this transition, but governments can support by ensuring the right legislative and regulatory structures are in place.”