Escalating global currency wars could result in further trade barriers against the UAE's airline and petrochemical industries, an adviser to the Central Bank has warned.

To avoid further turmoil, the IMF needs to police currency adjustments, says Dr David Dodge, a former Canadian central bank governor. Concern about trade barriers being erected was a "real issue", he said.

"Generally you don't get the trade barriers in the basic commodities, but you sure … get them in petrochemicals and airline protection, so that's what we have to be really worried about," Dr Dodge said.

He was appointed as one of four financial experts to the regulator's International Advisory Council last year.

Dr Dodge is in the UAE to advise Central Bank officials on policy ideas.

Disputes over currency valuations preoccupied policymakers globally last year, and evidence of a redrawing of battle lines has emerged in recent days.

Brazil, Chile and Peru are taking action to stem rises in their currencies caused by destabilising inflows of capital. Investment is flowing to fast-growing emerging markets as US and European economies tread water.

Guido Mantega, Brazil's finance minister, warned this week that events were building towards a world trade war.

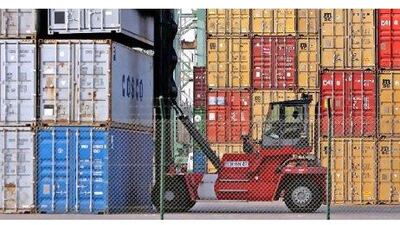

Any measures to limit international trade would have significant implications for the Gulf, which relies on flows of global goods and on foreign buyers of its oil.

The UAE's aviation and petrochemicals industries have already been embroiled in trade rows.

Airlines have been criticised by US and European competitors keen to limit their expansion.

The Organisation for Economic Co-operation and Development (OECD) last month agreed on proposals to end rules that give Emirates Airline, Etihad Airways and other carriers cheaper access to aircraft financing. The OECD initiative followed lobbying by European and North American airlines.

A related dispute about additional landing slots for UAE airlines in Canada has developed into a diplomatic row between the two countries.

Complaints about the UAE's petrochemical industry have involved the low prices that plastics producers pay for natural gas, the feedstock for producing a range of goods. In October the EU began imposing protectionist tariffs on plastics imports from the UAE for five years.

To head off the risk of more global trade protectionism, the rules of the game for exchange rate adjustment needed to be agreed, Dr Dodge said.

Neither the US nor China is playing by the rules, he said.

Responsibility for handling the process should be given to the IMF to make the organisation, based in Washington, DC, stronger and more representative, he said.

"It is in the interests of small, open economies such as the UAE and Canada that such changes take place," Dr Dodge said in a lecture in Dubai on Monday.

A dispute between the US and China over the valuations of their currencies has been at the heart of global currency disagreements. The US accuses China of preventing the yuan from rising and of accumulating currency reserves, leading to distortions in the world economy and trade.

China says quantitative easing by the US central bank weakens the dollar and creates excess liquidity, which is swamping emerging economies with destabilising capital inflows.