Banks in the GCC, particularly in the UAE and Saudi Arabia, will record stronger profitability this year on the back of higher net interest margins and lower-cost business models amid booming non-oil economic growth in the region.

While credit growth has slowed due to rising interest rates, robust gross domestic product growth in the non-oil sectors of Gulf countries will provide support to lenders in the region, S&P Global Ratings said in a report on Tuesday.

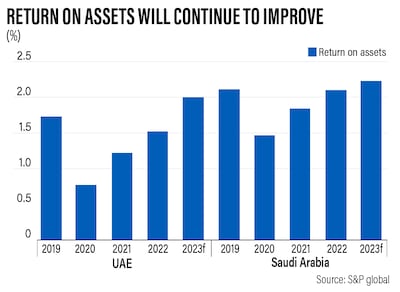

GCC banks' return on assets “will improve in 2023, mainly due to higher margins and still satisfactory, albeit lower, lending growth in some GCC countries”, the report said.

UAE banks, in particular, will benefit from non-oil GDP growth, which will “somewhat mitigate the negative effect of higher interest rates on credit growth”.

“We expect UAE banks' credit growth will improve to approximately 7 per cent in 2023, compared with 5 per cent in 2022,” the report said.

The UAE's economy, the Arab world's second-largest, grew by 3.8 per cent on an annual basis to Dh418.3 billion ($113.9 billion) in the first quarter of this year amid its push for diversification, officials said last month.

That was boosted by non-oil GDP, which rose 4.5 per cent year on year to Dh312 billion.

“We expect the UAE will report strong non-oil GDP growth of 6 per cent in 2023. This, in combination with recoveries from provisions booked in the past two years, will reduce UAE banks' credit costs in 2023, compared with 2022,” S&P said.

UAE banks' performance improved in the first half of 2023, on the back of lower credit losses and higher interest rates.

“We expect higher interest rates will continue to support banks' profitability and, in combination with still high non interest-bearing deposits, will moderate the increase in the cost of funding. The recovery of the non-oil sector has led to higher lending growth, compared with 2022.”

Meanwhile, in Saudi Arabia, higher interest rates will reduce banks' total lending growth to about 10 per cent this year, from 14 per cent in 2022, the report said.

But credit growth will remain strong on the back of the kingdom's Vision 2030 programme, which aims to diversify the country's economy away from oil.

“While higher interest rates will decrease Saudi banks' total lending growth, Vision 2030-related projects will keep credit growth well above the GCC average rate of 4 per cent in 2023,” S&P said.

“Increased corporate lending, higher interest rates, and portfolio seasoning will likely lead to an slight increase in non-performing loans and credit costs. Yet, Saudi banks' asset quality metrics will remain better than the peer average, due to a high exposure to government-backed mortgage lending,” it added.

Additionally, robust return on equity will support capital buffers, it said.

Saudi banks are also expected to achieve a return on assets of 2.2 per cent in 2023, compared with the GCC average of 1.8 per cent.

Saudi Arabia's economy grew by 1.2 per cent in the second quarter of this year, a slightly faster pace than the initial estimates, driven by a sharp expansion in the non-oil sector of the Arab world's biggest economy.

The kingdom’s gross domestic product at current prices reached 970 billion Saudi riyals ($258.66 billion) in the three months to the end of June, with the non-oil sector up by 6.1 per cent on an annual basis, the General Authority for Statistics said this month.

In Kuwait, higher interest rates will reduce bank's credit growth to about 3 per cent, from almost 8 per cent in 2022, S&P said.

“We expect higher interest rates will lead to lower demand from corporate and retail borrowers, which will translate into low single-digit loan growth for the banking sector,” it said.

While Kuwait's banking sector is well positioned to benefit from the higher-for-longer interest rate environment, the boost from net interest income will be “somewhat offset” by the migration from non interest-bearing to interest-bearing deposits and increasing credit losses.

However, the banking sector's funding profile “continues to benefit from a strong local deposit base and a net external asset position. This translates into positive investor sentiment”, the report added.

Overall, while higher interest rates and Opec oil production cuts will constrain short-term growth prospects, non-oil growth and, consequently, credit growth in the UAE and Saudi Arabia remain robust, S&P said.