The California Department of Financial Protection and Innovation has seized First Republic Bank, with JP Morgan Chase set to take over the failed lender after efforts to rescue it failed.

The DFPI appointed the Federal Deposit Insurance Corporation as receiver and accepted JP Morgan's bid to assume all deposits and purchase the assets of First Republic Bank, according to a statement on Monday.

As of April 13, First Republic Bank had about $229.1 billion in assets and $103.9 billion in deposits. According to the order of possession, the bank had $14.9 billion in available cash on hand as of close of business on April 28.

"The combination of continuing deposit outflows and replacing funding shortfalls with higher interest borrowings is not a sustainable business model. This has jeopardised the viability of the bank," the order said.

As a result, the DFPI said it took action in line with California financial laws after it deemed that First Republic was “conducting its business in an unsafe or unsound manner due to its present financial condition”, making it difficult for the bank to continue operating.

“Our government invited us and others to step up, and we did,” said Jamie Dimon, chairman and chief executive of JPMorgan.

“Our financial strength, capabilities and business model allowed us to develop a bid to execute the transaction in a way to minimise costs to the Deposit Insurance Fund.

“This acquisition modestly benefits our company overall, it is accretive to shareholders, it helps further advance our wealth strategy, and it is complementary to our existing franchise,” Mr Dimon said.

The agreement comes after financial turmoil engulfed mid-size regional banks in the US and led to the collapse of Silicon Valley Bank and Signature Bank last month.

JP Morgan led a group of 11 banks that extended a $30 billion lifeline to First Republic in March but the move failed to quell investor concerns.

Last week, San Francisco-based First Republic said it was taking steps to shore up its balance sheet and cut its workforce after deposits fell to about $104.5 billion in the first quarter of this year, from $176 billion in the fourth quarter of 2022, despite it receiving $30 billion from Bank of America, Citigroup, JP Morgan and Wells Fargo.

Without the cash provided by America’s largest banks, First Republic’s decline in deposits would have been about $102 billion during the March banking crisis.

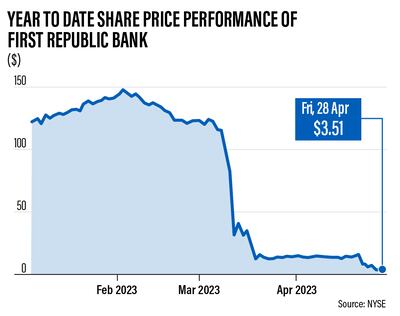

Despite First Republic's assurances, the share price of the lender tumbled and was down more than 97 per cent so far this year as of market close on Friday.

As part of the transaction announced on Monday, First Republic Bank’s 84 offices in eight states will reopen as branches of JP Morgan on Monday during normal business hours.

All depositors of First Republic Bank will become depositors of JP Morgan and will have full access to all of their deposits.

Deposits will continue to be insured by the FDIC and customers do not need to change their banking relationship in order to retain their deposit insurance cover up to applicable limits.

The FDIC insures deposits up to $250,000 per each individual account and institution.

The FDIC said on Monday that First Republic customers should continue to use their existing branch until they received notice on the completion of system changes that will allow other JP Morgan branches to process their accounts as well.

The FDIC and JP Morgan are also entering into a loss-share transaction on single family, residential and commercial loans it purchased from the former First Republic Bank.

As a result of this transaction, the substantial majority of First Republic ’s assets, including approximately $173 billion of loans and approximately $30 billion of securities have been acquired.

About $92 billion of deposits, including $30 billion of large bank deposits, will be repaid post-close or eliminated as part of the consolidation.

The FDIC will provide loss share agreements covering acquired single-family residential mortgage loans and commercial loans, as well as $50 billion of five-year, fixed-rate term financing.

JP Morgan is not assuming First Republic’s corporate debt or preferred stock.

JP Morgan said it expects an upfront, one-time, post-tax gain of approximately $2.6 billion, which does not reflect the approximately $2 billion dollars of post-tax restructuring costs anticipated over the next 18 months.

It said it remains very well-capitalised and maintains healthy liquidity buffers.

“The FDIC as receiver and JP Morgan Chase, National Association, will share in the losses and potential recoveries on the loans covered by the loss-share agreement,” the FDIC said.

“The loss-share transaction is projected to maximise recoveries on the assets by keeping them in the private sector. The transaction is also expected to minimise disruptions for loan customers.”

In addition, JP Morgan will assume all qualified financial contracts.

“The resolution of First Republic Bank involved a highly competitive bidding process and resulted in a transaction consistent with the least-cost requirements of the Federal Deposit Insurance Act,” the statement said.

The FDIC estimates the cost to the Deposit Insurance Fund will be about $13 billion, but said the final cost would be determined when it terminates the receivership.

"Traders understand that most of these [bank] failures are taking place due to the ultra-high interest rates, but the interesting thing is that the failure of this bank will change nothing for the Fed as it will still continue with its normal plans," said Naeem Aslam, chief investment officer at Zaye Capital Markets.

"This week we will see the Fed hike the interest rate by 25 basis points, but the important thing to watch out for now is how their future trajectory will look."