Shares of First Republic Bank lost almost half of their value on Tuesday as rattled investors took stock of the lender's disclosure a day earlier that its deposits had plunged by about $102 billion during the first quarter without a $30 billion lifeline from America's largest banks.

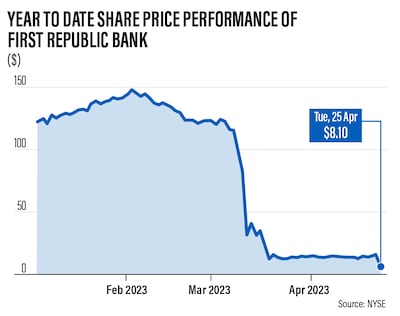

The shares plummeted 49.4 per cent to $8.10 at market close on Tuesday and are down more than 93 per cent since the start of this year.

On Tuesday, Bloomberg reported First Republic Bank is considering the sale of $50 billion to $100 billion of assets, which include long-dated mortgages and securities, in a bid to avoid a similar fate of Silicon Valley Bank and Signature Bank, which collapsed last month and sparked a banking crisis at medium-sized lenders in the US.

“The First Republic Bank drama revived the bank stress. Even before the US open, the European banks were dragging the European equity indices lower,” said Ipek Ozkardeskaya, a senior analyst at Swissquote Bank.

Invesco’s European banks ETF slid by 3.40 per cent.

On Monday, Switzerland's largest lender UBS lost more than 2 per cent despite saying it had attracted $28 billion in new money from wealthy clients in its global wealth management division, including $7 billion in the last 10 days of March after the announcement of its acquisition of Credit Suisse.

On Monday, San Francisco-based First Republic said it was taking steps to shore up its balance sheet and cut its workforce after deposits fell to about $104.5 billion in the first quarter of this year from $176 billion in the fourth quarter of 2022 despite it receiving $30 billion from Bank of America, Citigroup, JPMorgan Chase and Wells Fargo.

Without the cash provided by America's largest banks, First Republic's decline in deposits would have been almost $102 billion during the March banking crisis.

As of March 9, 2023, just before the collapse of Silicon Valley Bank that led to a banking crisis in the US, First Republic's total deposits were $173.5 billion, 1.7 per cent less than what they were at the end of 2022.

First Republic said it began to experience unprecedented deposit outflows on March 10 but things began to stabilise after it received the $30 billion on March 16. The unsecured deposits from the banks allowed First Republic to reduce its short-term borrowings and total deposits were $102.7 billion as of April 21, 2023.

“With the stabilisation of our deposit base and the strength of our credit quality and capital position, we continue to take steps to strengthen our business,” Jim Herbert, First Republic's executive chairman and Mike Roffler, the chief executive, said in a joint statement on Monday.

First Republic said it was taking actions to strengthen its business and restructure its balance sheet, which include boosting the portion of its insured deposits, reducing borrowings from the Federal Reserve Bank, and decreasing loan balances to correspond with the reduced reliance on uninsured deposits.

The bank is also taking steps to reduce expenses and it also expects to reduce its workforce by approximately 20 to 25 per cent in the second quarter.